Bitcoin News

SBF sent home and Binance gets Voyager assets: Hodler’s Digest

https://cointelegraph.com/magazine/wp-content/uploads/2022/12/IMG_4469-scaled.jpg

Top Stories This Week

SBF sent home after his parents put up their house to cover his astronomical bail bond

Sam Bankman-Fried will spend the holidays with his family in Palo Alto, California, after his parents secured $250 million in bail funds with the equity in their home. Among the conditions of the bail are home detention, location monitoring and his passport surrender. The former FTX CEO signed surrender documents on Dec. 20, allowing his extradition from the Bahamas to the United States, where he faces eight charges that could keep him behind bars for the rest of his life. Bankman-Fried will now wait for his sentence at home with his family.

Caroline Ellison and Gary Wang plead guilty to fraud charges

Former Alameda Research CEO Caroline Ellison and FTX co-founder Gary Wang have pleaded guilty to federal fraud charges. Ellison, however, is working on a plea deal with the Office of the United States Attorney for the Southern District of New York, which would evade all the seven charges against her, resulting in a $250,000 bail bond and prosecution only for criminal tax violations. The agreement doesn’t provide protection against any other charges that Ellison might face from any other authorities. Wang and Ellison are reportedly cooperating with U.S. authorities on investigations related to FTX’s collapse.

Read also

Genesis and DCG seek path for the recovery of assets amid liquidity issues

Global investment bank Houlihan Lokey has proposed a plan to resolve the liquidity issues at crypto lender Genesis and its parent company, Digital Currency Group (DCG). The plan, devised by Houlihan on behalf of a committee of creditors, would further provide a path for clients of crypto exchange Gemini to recover assets owed by Genesis and DCG. Genesis platform withdrawals have been suspended since Nov. 16, days after the company disclosed that nearly $175 million of its funds are stuck in an FTX account.

Binance.US set to acquire Voyager Digital assets for $1B

With a bid of $1.022 billion, Binance.US will acquire the assets of bankrupt crypto lender Voyager Digital. The sale, however, is subject to a creditor’s vote and closing requirements. A hearing will also be held by the presiding bankruptcy court to approve the purchase agreement on Jan. 5, 2023. In good faith, Binance has agreed to deposit $10 million and reimburse Voyager for certain expenses up to a maximum of $15 million.

Twitter adds BTC and ETH price indexes to search function

In its latest move into the crypto space, Twitter has added price indexes for Bitcoin and Ether to its search function. The new feature allows users to simply search for the ticker symbol, whether for a stock or crypto, and check price’s graph. Other cryptocurrencies, including Dogecoin, did not make the list. The company plans to expand its coverage in the coming weeks.

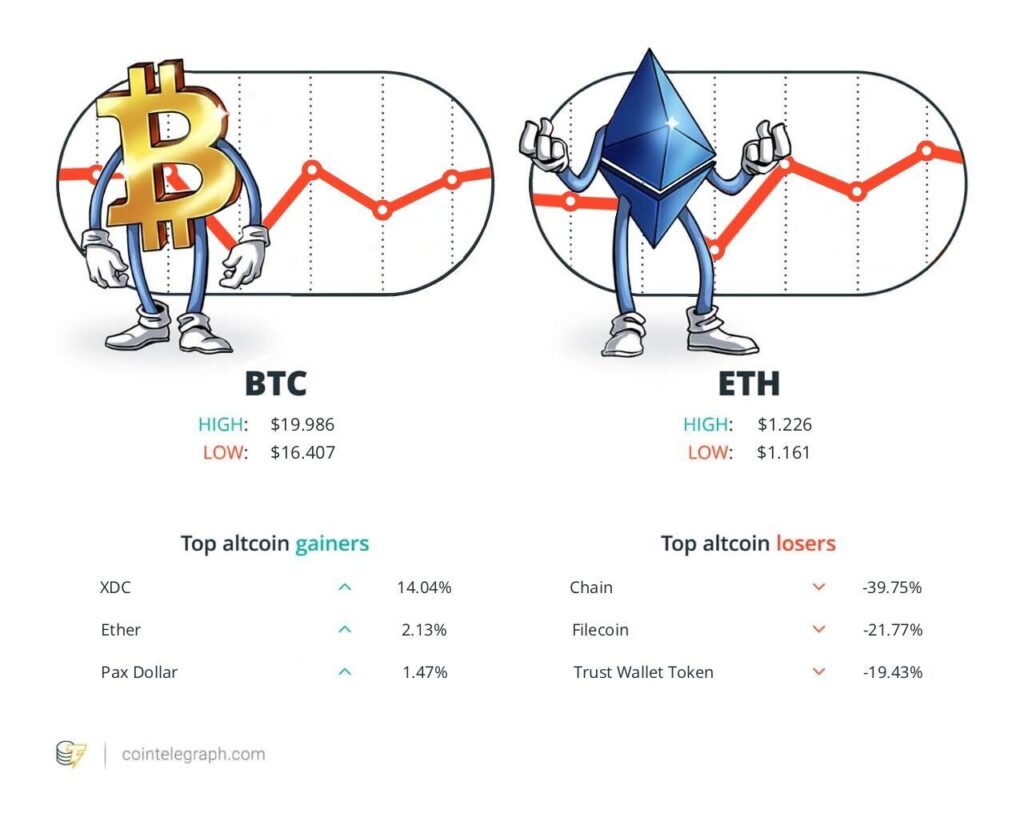

Winners and Losers

At the end of the week, Bitcoin (BTC) is at $16,835, Ether (ETH) at $1,218 and XRP at $0.35. The total market cap is at $811.38 billion, according to CoinMarketCap.

Among the biggest 100 cryptocurrencies, the top three altcoin gainers of the week are XDC Network (XDC) at 14.04%, Ether (ETH) at 2.13%, and Pax Dollar (USDP) at 1.47%.

The top three altcoin losers of the week are Chain (XCN) at -39.75%, Filecoin (FIL) at -21.77%, and Trust Wallet Token (TWT) at -19.43%.

For more info on crypto prices, make sure to read Cointelegraph’s market analysis.

Read also

Most Memorable Quotations

“Regulation should focus on intermediaries (the centralized actors in cryptocurrency), where additional transparency and disclosure is needed.”

Brian Armstrong, CEO of Coinbase

“This is why you have situations like the Mango exploit happen where the exploiter will first steal the funds and then start negotiating. There’s no proper incentive to report.”

“If you can make a wallet that a billion people use — that’s a huge opportunity.”

Vitalik Buterin, co-founder of Ethereum

“Decentralization will include blockchain as a foundational element, but other technologies will expand the potential in new ways that blockchain was never designed to do.”

“Argentina is becoming a hub for bringing tech development and resources to Latin America from the rest of the world.”

Ryan Dennis, senior manager at the Stellar Development Foundation

“The most challenging thing for [blockchain analytics] firms working on this today is when money moves off chain and into the banking system because they’re no longer able to track it.”

Peter Smith, founder and CEO of Blockchain.com

Prediction of the Week

Bitcoin dips below $16.7K as US GDP meets fresh BTC price ‘death cross’

Bitcoin prices dip below $16,700 at the end of the week, after recovering some ground on the previous day.

A Santa Claus rally for Bitcoin is unlikely to happen, as the mood among some pundits is firmly bearish.

Pseudonymous Twitter user Daan Crypto Trades called attention to Bitcoin’s yearly close, which is likely to be Bitcoin’s third negative performance year. “The percentage loss this year is sitting right in between the other two negative years, being 2014 and 2018,” he noted on Twitter.

FUD of the Week

Crypto platform Paxful removes ETH from its marketplace

Ethereum’s native token, Ether, is no longer available on Paxful, a peer-to-peer cryptocurrency exchange. Ray Youssef, CEO of Paxful, announced the move in a message to the roughly 11.6 million users of the platform. Among the reasons to unlist the token, Youssef mentioned Ethereum’s switch from a proof-of-work to proof-of-stake consensus, claiming the transition has turned ETH into a “digital form of fiat.”

California regulators order MyConstant to cease crypto-lending services

Over alleged violations of state securities laws, the California Department of Financial Protection and Innovation has ordered crypto lending platform MyConstant to cease operating. Mentioning peer-to-peer lending services and “unlicensed loan brokering,” the authority said MyConstant offered and sold unqualified non-exempt securities.

South Korean court freezes $92M in assets related to Terra tokens

South Korean authorities continue to investigate and freeze funds of the people involved with the Terra ecosystem. By order of the local court, several assets of Kernel Labs, a Terraform Labs affiliate, valued at $92 million have been frozen. Kernel Labs CEO Kim Hyun-Joong reportedly holds the largest amount of illegal proceeds from Terra. In November, assets worth over $104 million were also frozen following a request from South Korean prosecutors in the case.

Best Cointelegraph Features

What it’s actually like to use Bitcoin in El Salvador

Cointelegraph’s reporter Joe Hall attempted to spend two weeks in El Salvador living on Bitcoin. Spoiler alert, he failed.

The Metaverse is awful today… but we can make it great: Yat Siu, Big Ideas

We spend half our lives on the Internet, so we’re already in an early version of the Metaverse. But Animoca co-founder Yat Siu tells Magazine there’s a much better way forward.

The most eco-friendly blockchain networks in 2022

This year saw the realignment of the crypto industry toward greener, more energy-efficient blockchains.

Subscribe

The most engaging reads in blockchain. Delivered once a

week.

Source: https://cointelegraph.com/magazine/sbf-sent-home-ftx-heads-plead-guilty-binance-gets-voyager-assets-hodlers-digest-dec-18-24/

Bitcoin News

Nomura Group Unveils Bitcoin Fund Catering to Institutional Investors

Nomura Digital Assets, a subsidiary of Japan’s leading financial institution, Nomura Group, has ventured into the world of digital assets with the launch of a Bitcoin fund. This strategic move is designed to streamline access to digital assets for major investors, responding to the escalating demand for cryptocurrency investments. It marks Nomura’s maiden foray into providing investment solutions tailored to the digital asset arena.

In a press release dated September 19, Laser Digital Asset Management, the digital asset management arm of Nomura, proudly introduced the Bitcoin Adoption Fund, a specialized offering aimed squarely at institutional investors. This fund underscores the growing breadth of cryptocurrency adoption in Japan.

Facilitating Bitcoin Uptake

The Laser Digital Bitcoin Adoption Fund offers institutional investors an attractive proposition, blending cost-efficiency with robust security measures. In a bid to safeguard the fund’s holdings, Laser has enlisted the services of Komainu, a custody solution established in 2018, which is subject to regulatory oversight and jointly formed by Nomura, Ledger, and Coinshares.

Fiona King, the head of Laser Digital Asset Management, emphasized the fund’s meticulous management and compliance standards. Notably, the fund operates as a segregated portfolio within the mutual fund entity, Laser Digital Funds SPC.

Nomura Holdings foresees that its crypto-focused division, Laser Digital, will begin turning a profit within the next two years. This projection is a response to the surging demand for Bitcoin and other cryptocurrencies, pitting Nomura against established traditional heavyweights such as JPMorgan and Goldman Sachs.

While Laser Digital already offers Bitcoin derivatives to its institutional clientele, the prolonged bear market has impacted the company’s growth trajectory. Due to the recent downturn in cryptocurrency values, Nomura has cautioned that it might take longer than initially anticipated for Laser Digital to achieve profitability.

Bitcoin News

Bitcoin Surges to $32,500 in China: Here’s Why

The cryptocurrency market has witnessed a remarkable surge in the price of Bitcoin, and according to a renowned cryptocurrency analyst, this increase has a fundamental reason: Chinese buying. In a recent YouTube video, the CryptoBanter analyst dissected the factors behind this Bitcoin surge, which comes after a series of significant declines in August. In this report, we will delve into how Chinese buying has propelled the price of Bitcoin and how other factors, such as the depreciation of the Chinese yuan and its correlation with the U.S. Dollar Index (DXY), have influenced this exciting development in the cryptocurrency market.

The Flight from the Chinese Yuan: Bitcoin and Gold as Havens

One of the key factors behind Bitcoin’s recent surge is the increasing flight of Chinese consumers from their national currency. The Chinese currency has experienced depreciation in its value, leading many Chinese individuals to seek refuge in Bitcoin and gold. Economic uncertainty in China, exacerbated by crises in the stock market and the real estate market, has further eroded confidence in the Chinese yuan. As a result, Bitcoin and gold have become safe-haven assets for Chinese investors.

Bitcoin Reaches $32,500 in China

The CryptoBanter analyst reports that the demand for “digital gold” in China has driven Bitcoin’s price to astonishing levels. According to their observations, a single Bitcoin has reached a price of $32,500 in China and was then exchanged for USDT at $33,000. This represents a significant premium compared to the current price of Bitcoin in other markets, which stands at $27,135. This price disparity has created a substantial arbitrage opportunity for investors.

September Breaks the Traditional Bearish Pattern

September is typically a historically bearish month for Bitcoin, but this year has been a notable exception. Despite pessimistic predictions from many analysts, BTC has recorded a 4% increase in its price during this month. The CryptoBanter analyst suggests that this positive performance may foreshadow even greater gains in the future.

Correlation with the U.S. Dollar Index (DXY)

One interesting observation from the analyst is the correlation between the price of Bitcoin and the U.S. Dollar Index (DXY). According to their data, whenever the DXY reaches the level of 105, the price of Bitcoin tends to rise. This could indicate an inverse relationship between the strength of the U.S. dollar and the attractiveness of Bitcoin as an investment asset.

Long-Term Investors Continue to Accumulate

Despite the volatile market conditions, the analyst points out that long-term Bitcoin investors have increased to over 75%. This suggests sustained confidence in the long-term potential of the world’s largest cryptocurrency, even amid price fluctuations.

Bitcoin in the Last 24 Hours

According to CoinMarketCap data, in the last 24 hours, Bitcoin has experienced a 0.79% increase. On the weekly price chart, the leading cryptocurrency has risen by 4.56%. At the time of writing this report, Bitcoin has a market capitalization of $528 billion, solidifying its position as the largest and most robust cryptocurrency network in the world.

In Conclusion…

Chinese buying has proven to be a crucial factor in the recent surge of Bitcoin, challenging the traditionally bearish expectations for September. As the cryptocurrency continues to evolve and attract the attention of investors worldwide, the relationship between Bitcoin and global economic events will remain a topic of interest and discussion within the crypto community.

Bitcoin News

This Analyst Predicts a Bright Bullish Future for Chainlink (LINK)

In an exciting revelation, prominent cryptocurrency analyst Michaël van de Poppe has shared his insightful analysis of Chainlink (LINK), one of the standout cryptocurrencies in today’s market. Van de Poppe, widely recognized in the crypto community, has caused a stir with his bullish predictions for this decentralized oracle network. Let’s delve into the details of his analysis and understand why he foresees a bright future for Chainlink.

Van de Poppe’s Chainlink Analysis

According to Van de Poppe’s analysis, Chainlink has reached its minimum level and is poised for a reevaluation phase that could offer extremely lucrative buying opportunities. His expert view focuses on a specific price range: $6.15 to $6.40. For investors, this range presents itself as a strategic entry point that could result in substantial gains in the near future. Van de Poppe has even set an ambitious price target of $8, suggesting an impressive bullish potential.

Technical Analysis: Bullish Outlook

Chainlink’s technical analysis supports Van de Poppe’s claims. The 4-hour chart for LINK/USD reveals that the altcoin remains above all moving averages, a positive indicator of the current bullish trend. Furthermore, the chart shows that Chainlink is struggling to break above the upper band of its symmetrical triangle pattern, which could mark the beginning of a significant rally.

The MACD indicator also lends support to the idea of a bullish breakthrough, with two consecutive higher highs indicating an upward momentum. Although the RSI remains neutral, it is above the 50 level, suggesting room for further growth in Chainlink’s price.

Key Levels and Resistance

In recent days, bears attempted to push Chainlink’s price below $6.55, but strong buying pressure at this level prevented a significant decline. This demonstrates the strength of buyers in the area. After this attempt at a downward correction, the price returned and reached the supply zone at $6.68. At this point, several double-bottom patterns were observed, a bullish indicator according to technical analysis.

Chainlink’s Potential

The pivotal moment came in the previous 4-hour timeframe when bulls gained momentum by surpassing the resistance at $6.70. This bullish breakthrough led the price to steadily rise, reaching an intraday high of $6.88, which is close to the 200-exponential Moving Average (EMA), a significant technical indicator.

However, as in any financial market, there is always the possibility that bulls may lose their momentum. In that case, we could see a retracement to the main support level at $6.45. If this level fails to hold, a more significant correction to $6.0 is possible, potentially opening the door to a bearish trend.

Conclusion

In summary, Michaël van de Poppe, with his impressive track record of predictions, has put Chainlink on the radar of many investors. His technical analysis supports his bullish outlook and highlights key levels to watch. As this cryptocurrency continues to attract attention in the crypto community, investors will be eager to see if Chainlink lives up to expectations and reaches new highs on its exciting journey towards $8 and beyond. Stay tuned for market updates, as exciting opportunities can arise in the world of cryptocurrencies.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know