Tutorials

How to set up a Bitcoin node: beginner’s guide

- A Bitcoin node is a piece of software that enforces the network’s consensus rules by verifying new transactions sent by users and blocks added by miners.

- Running self-owned nodes can protect users’ privacy and prevents them from accepting fraudulent fork coins.

- All miners are Bitcoin nodes, but not all nodes are Bitcoin miners.

- A user can either run a full node, light-node, or pruned node based on their usage.

Bitcoin’s peer-to-peer strength lies in its vast network of nodes. The famous saying in crypto, “not your private keys, not your coins”, extends to crypto nodes as, “Not your node, not your rules”.

Bitcoin full nodes protect user privacy and strengthen the network’s distributed consensus. And just recently, the network hit an all-time high for active nodes, making the network all the more robust.

Setting one up is not only easy but incredibly important for the sustained health of the Bitcoin network. Moreover, the lightning network (LN) provides a way to incentivize Bitcoin node operators and channel liquidity providers (LPs).

In this guide, Crypto Briefing walks readers through why they should set up a Bitcoin node and how to do it on various devices.

What is a Bitcoin node?

A Bitcoin node is a program that validates transactions and blocks. There are different types of nodes ranging from a full node, a light node, and pruned full nodes. There are technical differences between each class, but Bitcoin nodes, no matter the format, assist in enforcing the network’s consensus rules.

Consensus rules are the set of conditions coded into the network.

A Bitcoin node enforces these rules by verifying the private address and balance when sending a BTC payment.

A full node is connected to a network of other nodes that form the distributed consensus network.

A node does not have to trust other nodes for verifying payments. It validates them itself before broadcasting across the network.

Bitcoin nodes’ network quickly disregards a node that tries to propagate incorrect information by banning it for at least 24 hours or even longer, depending on the number of incorrect propagations.

Bitcoin wallets and nodes

A Bitcoin wallet or address is a set of two numbers—a public key and a private key—encrypted together.

Bitcoin users send transactions using this pair of numbers, which constitute a wallet.

The wallet interacts with a Bitcoin node, which verifies and broadcasts the transaction across the network.

These wallets can be connected to online servers and nodes supported by the wallet or a user’s self-hosted node. A user can choose any of the following:

- Exchange Wallet: A third-party wallet where the wallet’s private key is often hidden from the user or shared with a third-party app. These wallets are vulnerable to security risks and exchange hacks, which have happened numerous times in Bitcoin’s history.

- Simplified Payment Verification (SPV) Wallets: These are software wallets that interact with full nodes via blockchain headers. The SPV wallet can confirm the addition of the transaction in a block using these block headers. Examples include Electrum, Blockstream’s Green Wallet, and several others.

- Self-Owned Nodes: Miners, businesses, and privacy-conscious users rely on self-owned full nodes, which connect directly to the blockchain without any third-party intermediary. Hence, ensuring the privacy and security of Bitcoin addresses.

If a transaction is invalid—wrong address, insufficient balance, or otherwise—then the node ignores the transaction.

Difference between full node and miner

Validators or nodes in the Bitcoin money network solve three primary issues: confirming the authenticity of a transaction, protecting the privacy of individuals, and avoiding double spends.

In the original Bitcoin Whitepaper, mining nodes were inseparable from full nodes. Satoshi Nakamoto wrote:

“The system is secure as long as honest nodes collectively control more CPU power than any cooperating group of attacker nodes”.

Due to stiff competition and growth of specialized mining machines, miners have become “specialized nodes”, which perform additional work beyond merely verifying the transactions.

All miners are Bitcoin nodes, but not all nodes are Bitcoin miners.

The miners work to solve the energy-intensive Proof of Work (PoW) problem to add blocks to the main blockchain. The mining software receives transactions from nodes, order them in a linear data set (a block), and finally, compete against other miners to add their block to the blockchain.

Double spend refers to when an address spends more Bitcoin than it holds by duplicating the tokens or sending transactions simultaneously. For instance, person A with one BTC sends two transactions of one BTC each to Person B and Person C.

Satoshi Nakamoto solved this issue by designing the network as a “timestamp server”.

The mining nodes order the transaction in a time-based data stack, constituting a block. Hence, as soon as the first transaction gets registered to a block, let’s say that A to B of one BTC is sent and recorded; then the second, insufficient transaction will be rejected.

When miners successfully add a block to the network, a full node independently and authoritatively verifies all the transactions in that block. Thus, if the miner adds an invalid transaction to the block, the nodes will reject that block.

A transaction receives its first confirmation only when the block containing the transaction gets ratified by a full node.

The number of confirmations of a transaction is a metric obtained by subtracting the block number that stores the payment from the current block height.

Moreover, one does not have to be a node if they’re doing proof-of-work (PoW) for a mining pool. In this case, the mining pool adds the block based on consensus rules for them.

In sum, miners are responsible for storing the transactions into a block, whereas nodes determine if transactions and blocks follow the consensus rules.

Privacy protections

All information on Bitcoin is publicly logged, including the balance and a history of all transfers ever made using all addresses. A public record of credits makes a Bitcoin user vulnerable to a privacy breach, as an address can effectively tag individuals.

The fully validating Bitcoin node, on the other hand, receives and transmits data without any distinction, making it is not easy to ascertain the IP address of the incoming node.

Moreover, a fully validating user may want to consider hiding their IP address by implementing the Tor network. While there are only about 11,500 visible full nodes, experts have said that, in reality, many are operating behind the closed curtains of the Tor network.

Running a Bitcoin node also protects users from spending their coins on a forked network, as their node continues to abide by the rules of the unforked blockchain.

For instance, since Bitcoin Cash is a fork of Bitcoin, they share the same address. Hence, if a wallet does not support Bitcoin Cash or vice-versa, sending transactions to the wrong wallets may lead to loss of funds, especially if sent to an exchange or third-party wallet without a private key back up.

In the worst case, dubious apps and hackers may lead an informed user to believe that they are receiving Bitcoin when it might actually be a forked coin.

How to set up a Bitcoin node

A Bitcoin full node is a server that stores all the transactions ever made on the blockchain. The full node verifies the balance on a wallet using this history and validates transactions according to consensus rules.

Thus, owning a Bitcoin full node requires memory space. The size of the Bitcoin blockchain increases linearly in time; currently, it is around 320 GB.

Currently, the average BTC block size is 1.3 MB. The entire node space increases by a little more than one GB in a week at less than ten minutes per block.

Owners may choose the older version of HDD hard drives or the newer solid-state drives (SSD). The downloading and verification is faster on an SSD versus HDD.

The other requirements for running a full node are:

- A hardware device with an operating system, a desktop, wallet. There is also open-source software for stand-alone devices like a Raspberry Pi.

- Hard drive/Solid State Drive 500 GB.

- RAM at least 2 GB

- An internet connection with high limits for uploads and downloads.

Bitcoin Core is the most popular GUI for setting up a node. The Bitcoin core team, which comprises leading blockchain developers, releases new clients with bug fixes and protocol updates. Most recently, the community has been working on the significant Schnorr/Taproot update.

Users can find the instructions to set up a full node using Bitcoin Core here.

It may take days for the entire history to download for a full node, also called archival nodes. The software needs an internet connection to perform validating tasks and sending transactions.

Bitnodes has built a public repository of Bitcoin nodes worldwide. Users can find their nodes on this online library and also connect to other nodes worldwide.

There are other ways of running a node as well.

A pruned node is one in which the Bitcoin Core software keeps the complete data of the latest blocks only.

Pruning means removing the unwanted or superfluous part from the active components. A pruned node works similarly; it deletes a significant portion of the 350 GB information to five GB by replacing block data with index headers.

A user can specify disk space assigned to a pruned node. However, it must be greater than 288 MB, the minimum to keep at least two days worth of complete block data.

The block index holds all the metadata related to the entire blockchain.

A lightweight Bitcoin node or light node is an alternative that requires less space than full nodes. A light node only downloads the block headers instead of the entire history.

They depend on full nodes to validate transactions; the network of full nodes treats them as an extension of their work.

BTCPayServer and RaspiBlitz are popular open-source solutions that enable full node capabilities on a $100 microprocessor Raspberry Pi with a suite of other features like merchant payment processing.

The instructions to set-up a BTCPayServer on a computer or microprocessor like Raspberry Pi can be found here.

Future incentives

Bitcoin nodes can also choose to participate in the lightning network (LN). All Bitcoin node software comes with the LN activation option.

The lightning network (LN) is developing into a way to incentivize these nodes. The lightning network is expanding using an associate relationship. If A and B have a lightning channel and B and C have one, A automatically gets connected to C.

The next step is building lightning payments and adding sufficient liquidity to Bitcoin’s second layer. An online marketplace like Lightning Pool pays LPs on the network to facilitate payments.

Tutorials

How to get started with Binance Smart Chain (BSC)

Binance Smart Chain (BSC) has been booming with activity. Ranging from token swaps to decentralized money markets and cute NFTs, there are many options to earn yield or simply to have fun.

But what do you need to get started, and how do you do it? We’ll go through it all in this article.

Introduction

First, if you’d like to get an overview of the technology behind BSC, check out An Introduction to Binance Smart Chain (BSC).

That article can give you a walkthrough of the mechanics of the blockchain, while this one will provide practical information about how to get started. So let’s dive in.

Binance Smart Chain (BSC) wallets

First things first, you’ll need a wallet to interact with the applications on BSC. The good news is that you have quite a few options to choose from.

It’s worth keeping in mind that this isn’t an exhaustive list. In addition to the ones mentioned below, you can also use Math Wallet, Ledger, TokenPocket, Bitkeep, ONTO, Safepal, and Arkane.

MetaMask

Something you might already be familiar with is MetaMask. If not, no worries, we’ve got your back – we have a guide on How to Use MetaMask.

But wait, isn’t MetaMask an Ethereum wallet? It is, but actually, it’s quite easy to connect it to BSC. This way, you can use a familiar UI when interacting with BSC.

As to how to connect your MetaMask to BSC? We’ve got a detailed guide about it, so check out Connecting MetaMask to Binance Smart Chain if you’re interested.

Trust Wallet

Some dApps, such as PancakeSwap, allow you to connect using Trust Wallet.

Trust Wallet is one of the easiest mobile wallets to use, so if you’d like to use BSC from your pocket, it’s among the best options.

Binance Chain Wallet

Binance Chain Wallet is another option that you have for certain apps on BSC. You can get it as a browser extension for Chrome, Firefox, and Brave. It’s easy to use and has a slick UI.

How to get crypto to Binance Smart Chain (BSC)

So, now we have plenty of wallets to choose from, but how can we move funds to the chain? We can withdraw from our Binance account or use the Binance Bridge.

Before we go further, however, it’s important that we clear up some conceptual background.

Binance Smart Chain supports the BEP-20 token standard, while Binance Chain, the home of Binance DEX, supports the BEP-2 token standard. If you’d like to trade on Binance DEX, you’ll need to use BEP-2 tokens, while if you’d like to use dApps on BSC, you’ll need BEP-20 tokens.

Withdrawing from Binance

Chances are if you’re reading this, you already have a Binance account. The easiest option may be to simply withdraw from your Binance account to a BSC wallet.

Just make sure to select Binance Smart Chain (BEP-20) when withdrawing funds to your external wallet.

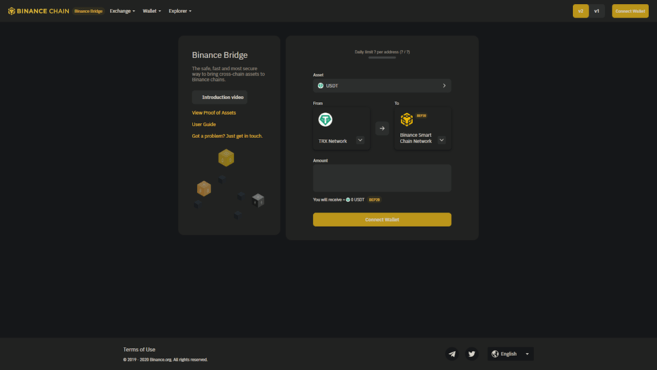

Binance Bridge

Another great way to bring assets to BSC is using the Binance Bridge.

You can select many of the biggest blockchains, such as Ethereum or TRON, and convert their native tokens to wrapped tokens on BSC. The bridge works in both directions. You can monitor the on-chain reserve that ensures that the wrapped tokens on BSC are sufficiently collateralized by the native tokens here: Proof of Assets.

If this seems like your preferred way of getting assets to BSC, check out our guide to Binance Bridge.

Binance Smart Chain (BSC) dApps

So, now we’ve got a wallet, and we’ve transferred some funds to it. What can we do with our magic internet money? Let’s take a look at some of the most popular decentralized applications on BSC.

And don’t forget that these are just a few of the biggest ones. New and exciting dApps are getting launched all the time. You can track them on DefiStation, DappRadar, or the Math dApp Store.

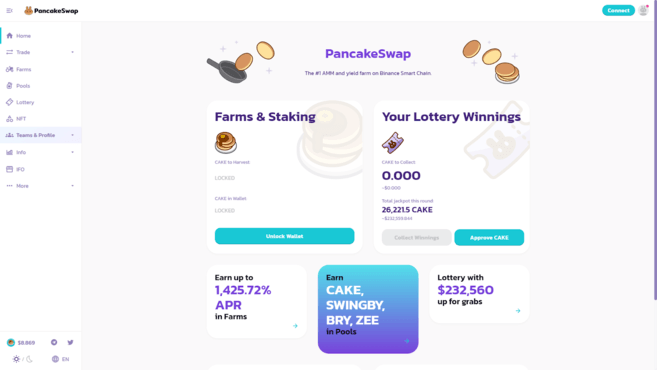

PancakeSwap

PancakeSwap is the number one automated market maker (AMM) on Binance Smart Chain.

Similar to Uniswap or SushiSwap, you can do token swaps for BEP-20 tokens on PancakeSwap.

You can also earn passive income by providing liquidity to one (or more) of the liquidity pools. Just be aware of impermanent loss before depositing.

While the AMM is at the core of PancakeSwap, there’s much more you can do. You can also take part in the lottery, win NFTs, participate in token sales, compete for spots on the leaderboard, and more!

If you’re interested, check out our detailed guide about PancakeSwap.

Venus

Venus is a borrow-lending protocol similar to Compound or Aave on Ethereum. It’s a decentralized money market where you can borrow and lend BEP-20 tokens with algorithmically set interest rates.

Have some idle funds lying around? Venus can be an option to earn interest on them or use them as collateral to borrow against to participate in yield farming.

Venus also enables a decentralized stablecoin called VAI, which is backed by a basket of cryptoassets. In this way, you could think of Venus as a hybrid of Compound and MakerDAO on BSC.

Autofarm

Autofarm is a yield aggregator on BSC. You can think of it as similar to yearn on Ethereum. It automatically tries to find the most optimal way for you to earn a yield on your deposits.

BurgerSwap

BurgerSwap is also a popular AMM on BSC. You can do BEP-20 token swaps and provide liquidity.

Spartan Protocol

The Spartan Protocol is a synthetic asset protocol on BSC. It allows users to create liquidity pools for BEP-20 tokens – just like many other AMMs.

However, it aims to allow for much more in the future, such as the creation of synthetic assets collateralized by liquidity pools, as well as lending and on-chain derivatives.

Cream

Cream is a popular lending protocol on Ethereum that is also deployed on BSC. You can borrow and lend BEP-20 tokens.

How to track Binance Smart Chain (BSC) metrics

So, now we have almost everything to get started. But how will we track our activity on BSC? Well, BscScan is the best place.

If you’ve been involved with DeFi at all, the site may look a bit familiar. It looks and feels very much like EtherScan – that’s because it’s made by the same team that made EtherScan.

So once you’ve found your addresses, what else should you keep an eye on? There are several handy metrics that track the ongoing activity on BSC, and we’ve collected them in this article: 6 Binance Smart Chain (BSC) Metrics You Should Know.

Closing thoughts

Binance Smart Chain has seen some significant development and user activity, and it’s only bound to increase in the future.

If you’re interested in DeFi, It may be worth keeping a close eye on it. Where’s the best place to do that? Follow the Binance Chain Community Twitter for the latest updates about BSC.

Do you still have questions about the Binance Smart Chain? Check out our Q&A platform, Ask Academy, where the Binance community will answer your questions.

Tutorials

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

You’re going to need the Dapp browser for this. If you’re on iOS, here’s how to use the Dapp browser on your phone.

What is PancakeSwap?

PancakeSwap is a new Automated Market Maker (AMM) aiming to be the #1 liquidity provider on Binance Smart Chain. You gain CAKE tokens by providing liquidity to the platform, staking and also get a chance to win some CAKE tokens through a lottery.

The CAKE Token

Token: CAKE

Contract Address: https://bscscan.com/token/0x7d813C828b0d1083Bb08b38841C45304A920060b

Chain: Binance Smart Chain (BEP-20)

Emission rate:

Reward per block — 25 CAKE

Daily emission (Based on 30k blocks per day) — 7,500,000 CAKE per day

To get started, you need to have the some tokens that you will be supplying to the platform. We will try to get some CAKE tokens thru their Exchange. Make sure you have the latest version of Trust Wallet installed on your mobile device.

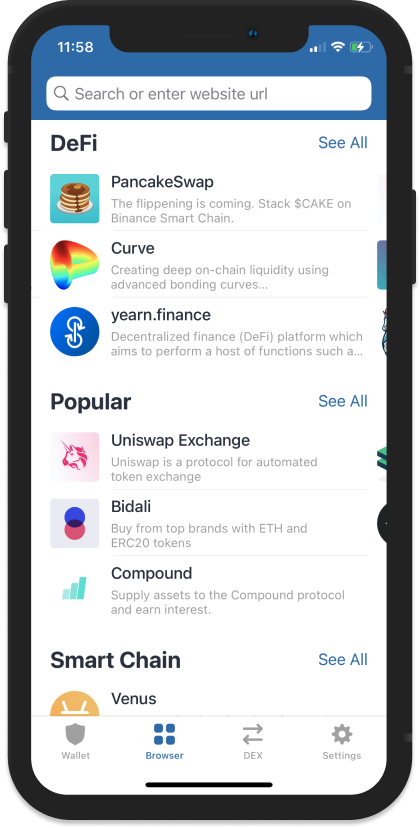

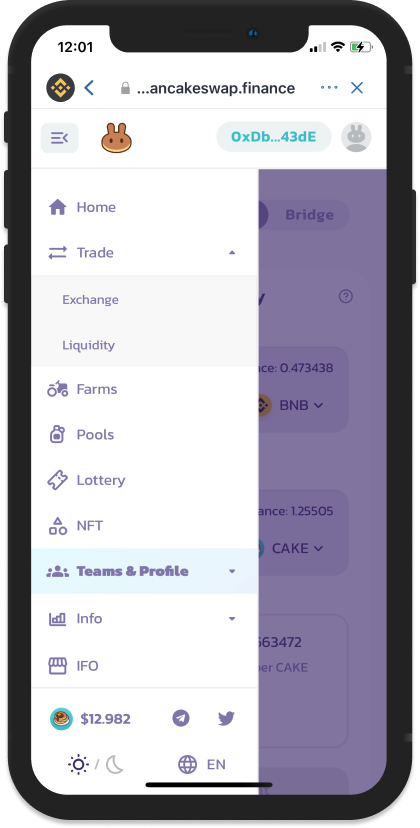

How to exchange tokens

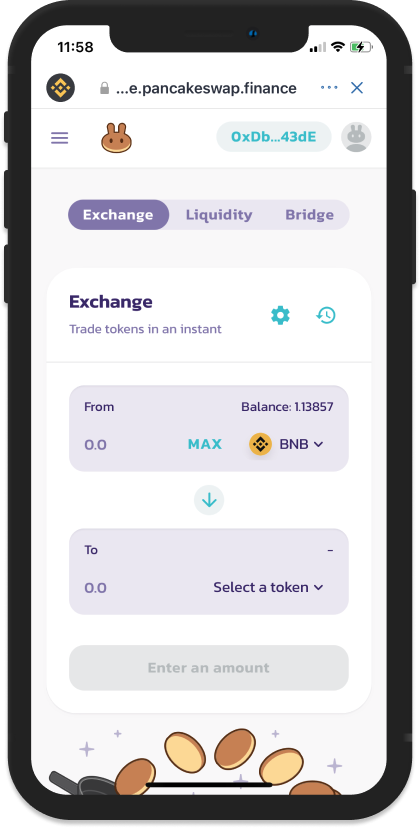

Access your DApp browser and then tap on PancakeSwap on the DeFi section. Alternatively, you can go to their website: https://exchange.pancakeswap.finance. PancakeSwap has a lot of tokens that you can swap to. Just make sure you have some BNB on your Smart Chain address for the network fees.

Note: If the DApp browser is not connecting to the site, make sure that the network you are connected to is the Binance Smart Chain. You can follow this guide: Access Binance Smart Chain DApps with Trust Wallet.

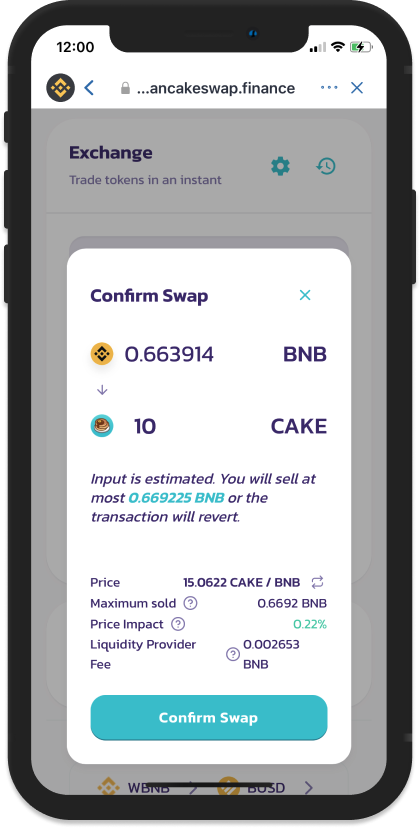

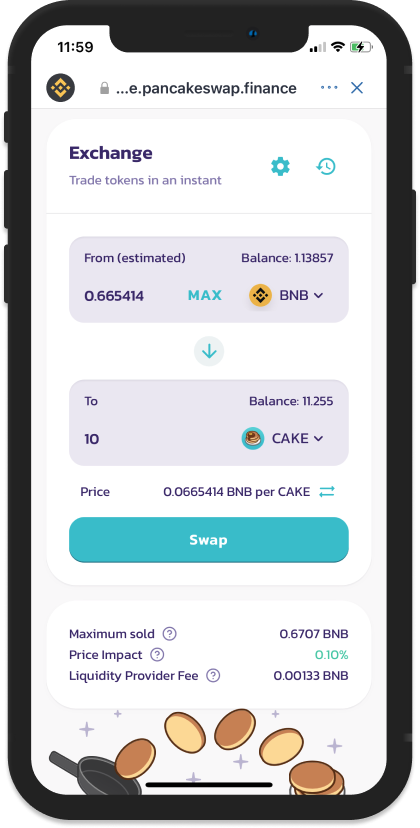

Select CAKE tokens and input the amount of tokens you are willing to spend or how much you’d like to receive. Once you’re ready, tap on Swap.

Confirm your transaction, and wait for the network to process it. When it’s done, you’ll have some CAKE tokens!

How to farm CAKE Tokens

There are several ways to farm CAKE Tokens on Pancake Swap. You can either Provide Liquidity, stake your FLIP tokens or stake CAKE tokens.

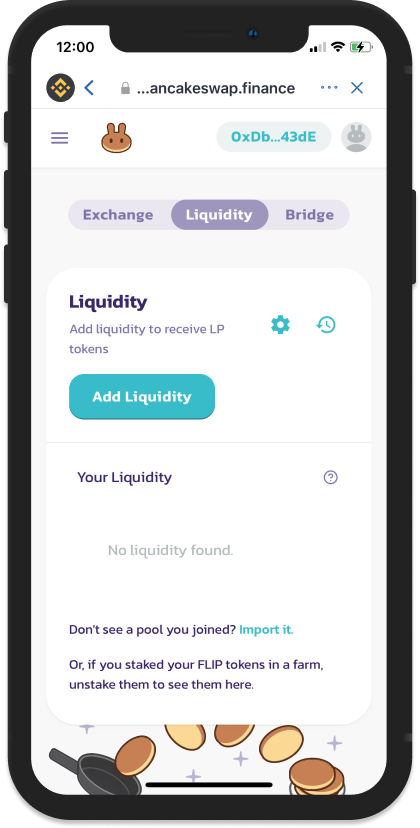

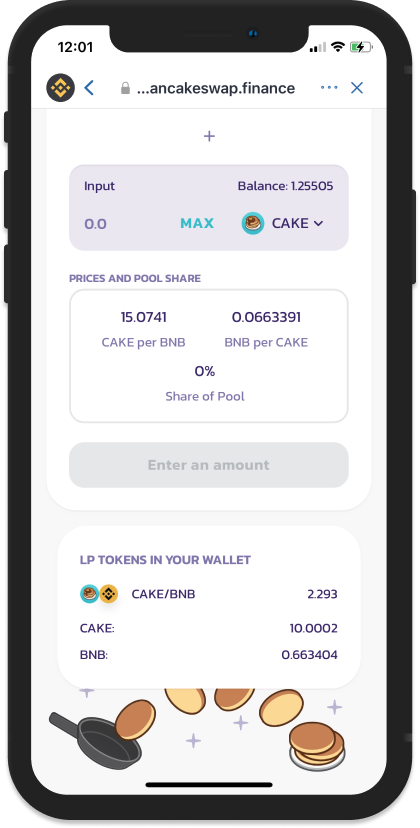

Provide liquidity and earn CAKE

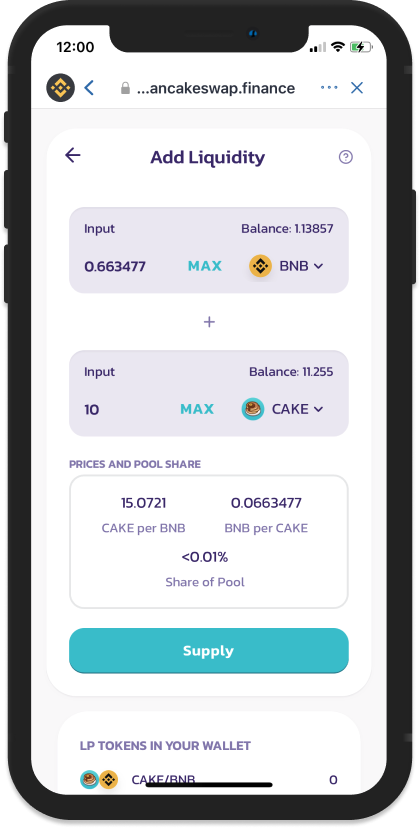

Tap on Liquidity to start supplying tokens to the PancakeSwap platform. To continue, tap on Add Liquidity. Choose the tokens that you want to deposit and Approve it first. Input the amount of tokens, the platform will automatically calculate the amount that you need to provide.

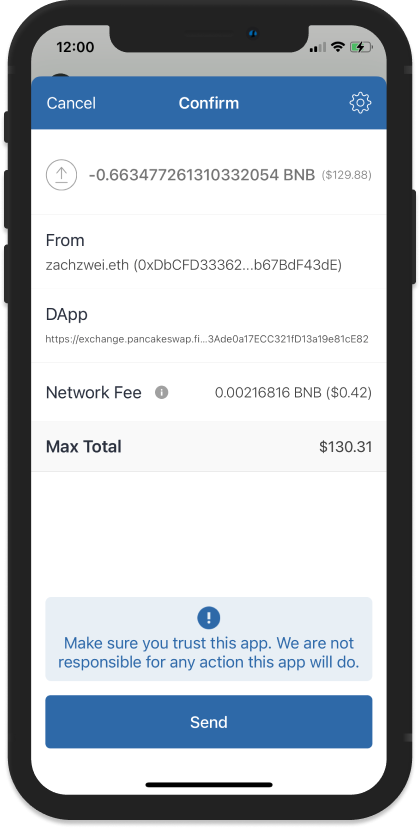

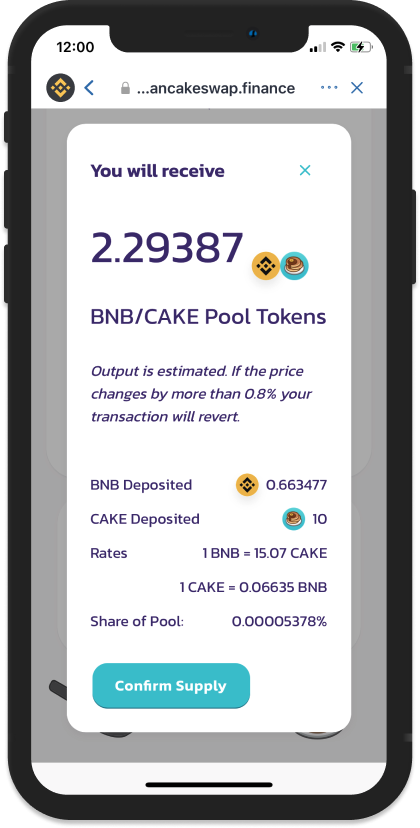

Tap on Supply and then Confirm. Then, the app will ask you again to confirm. Press Send to deposit your tokens to the platform.

You will see a confirmation once the tokens have been supplied. You will gain Liquidity Provider (LP) tokens which gives you a share of the fees that the Pancake Swap exchange earns. These LP tokens are also called FLIP tokens.

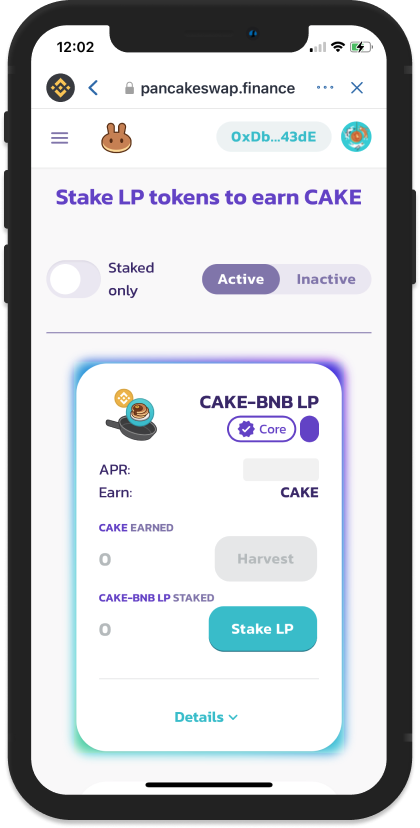

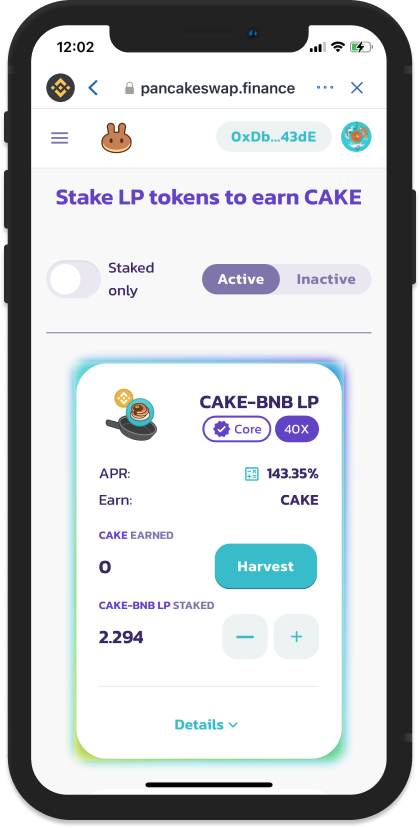

Staking LP tokens

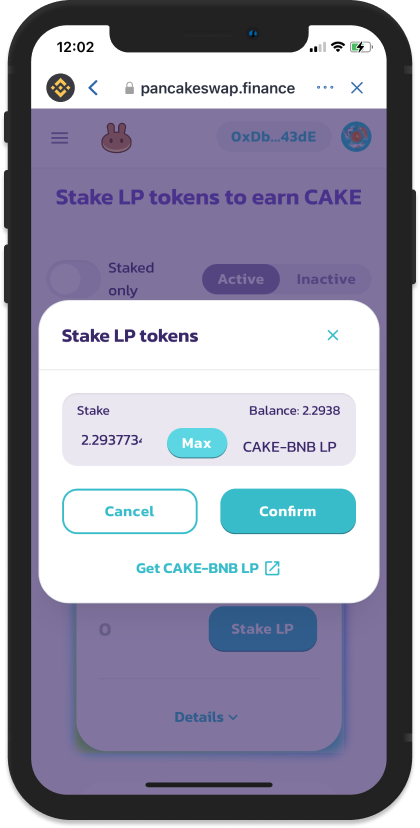

To maximize the rewards, you can stake your FLIP tokens. Tap on the 3 lines on the upper left to go to the Home Menu. Next, tap on Farms to access the PancakeSwap “Kitchen” and select the corresponding LP tokens you have supplied. Choose the CAKE-BNB LP Farm.

Approve it first in order to proceed. Tap on Stake LP to input the amount of LP tokens you want to Stake. Confirm the transaction. You will immediately earn CAKE tokens.

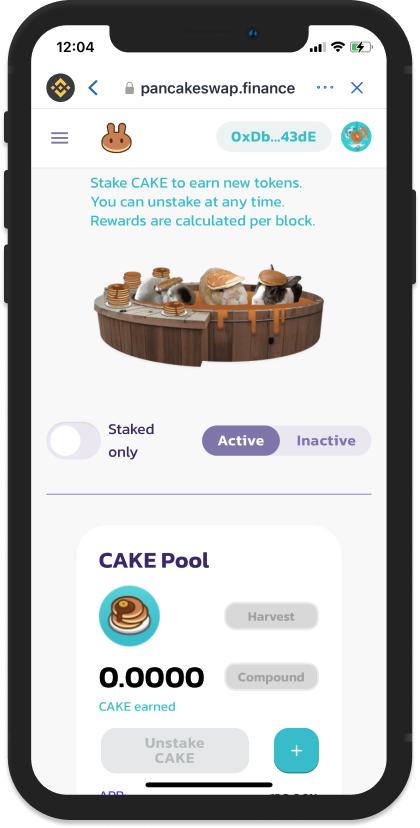

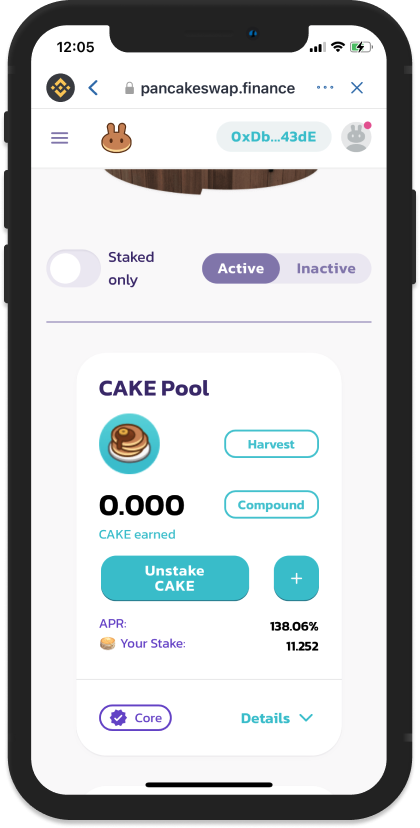

Staking CAKE Tokens

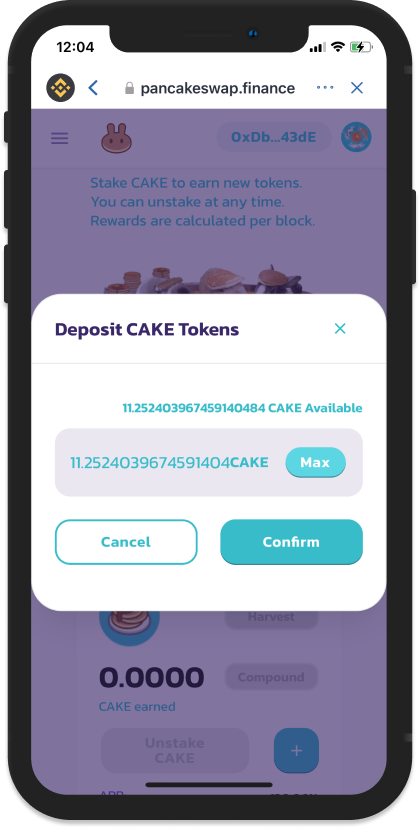

If you do not want to supply your CAKE tokens to the platform, you can just Stake them. Staking CAKE tokens on the individual Staking pools will generate additional tokens. In this guide, we will Stake CAKE to earn more CAKE.

Go back to the Home Menu, tap on “Pools”.

Note: SYRUP has been discontinued due to an issue discovered in the token contract. All existing and future SYRUP Pools will be migrated to CAKE-based pools.

Approve staking of the CAKE tokens first. Press the + sign to input the number of CAKE tokens you want to stake and Confirm it.

Your CAKE tokens will be staked and you will earn additional CAKE tokens. Harvest your CAKE at anytime and stake it again to gain more tokens.

Tutorials

How to buy Dogecoin (DOGE) on exchanges?

To start with, it is not available on Coinbase. In fact, many users who buy this cryptocurrency are small investors or amateur traders, and Coinbase is a platform widely used by these types of people. Therefore, many people look for it on this exchange, but don’t find it simply because it’s not there.

Instead, the platform on which it is most traded is Binance, which is also the largest crypto exchange in the world.

However, it must be said that on this exchange the largest trading volumes of DOGE are not in fiat currency, but in stablecoins.

That is, most people who buy DOGE on Binance do so with USDT or BUSD, which are two stablecoins pegged to the US dollar. Both of these stablecoins can be bought on Binance if you wish.

However, the DOGE/EUR exchange pair on Binance has significant volumes, so if you want to buy Dogecoin in euros, you can do so on Binance. If you want to buy in US dollars, you need to use the US version of Binance, Binance.us.

How to buy Dogecoin outside Binance

The second exchange on which it is traded in USDT is VCC Exchange, but there are also significant volumes on OKEx, Huobi Global and XT, also in USDT.

As an alternative to Binance.us, those wishing to buy DOGE in US dollars can use the Kraken exchange, which has even more significant trading volumes for the DOGE/USD pair. There are also significant trading volumes in euros on this exchange.

In reality, however, there are many exchanges on which you can buy DOGE, even in other fiat currencies, so much so that both CoinMarketCap and CoinGecko report at least 100 different trading pairs on various exchanges.

So to buy Dogecoin you simply need to choose an exchange where there is a DOGE trading pair in the currency you want to use for your purchase. The CoinMarketCap and CoinGecko lists allow you to check which are the main pairs, and on which exchanges they are found.

Usually, it is best to choose pairs with higher volumes, because they are more liquid, and therefore with prices that follow the trend with greater precision, and lower spreads between the selling and buying prices.

Once you have chosen the right exchange, you will need to register, if you haven’t already done so, verify your identity if necessary, deposit the currency you intend to use for the purchase, and place a purchase order in the relevant exchange pair with DOGE. These procedures vary from exchange to exchange, but one thing is usually the same: on purchases made with credit or debit card transactions there are generally higher commission costs. Therefore, if you wish to make a purchase in fiat currency, it is best to deposit the funds by bank transfer.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know

-

DeFi News3 years ago

PancakeSwap has surpassed Ethereum in transaction volume