DeFi News

SushiSwap has recorded TVL growth from 171% to over $ 3 billion in one month

SushiSwap has gained 9.29% in the last 24 hours to become one of the best performing decentralized exchange platforms of the day with over $3 billion in total value locked (TVL), compared to $1.2 billion at the start of the year.

A new report by DeFi metrics site DappRadar shows that a 93% increase in user activity on the platform has more than doubled SushiSwap’s TVL, which rose by 171% in the last month.

“Decentralized exchange platform SushiSwap has doubled in size since the start of this year. The amount of unique active wallets increased by 93%. While the total volume locked in the platform’s smart contracts increased 171%”.

SushiSwap is an Ethereum-based DEX that allows users to swap tokens for yield farming, which involves locking up crypto or tokens in return for rewards. SushiSwap users need to swap tokens to participate in different liquidity pools without necessarily affecting demand or supply as in centralized exchanges.

SushiSwap and Yield Farmers

SushiSwap was forked from Uniswap by a developer popularly known as Chef Nomi and announced on August 27, 2020. It quickly became a phenomenon in both the traditional and crypto market when it crossed over $700 million in TVL within three days of launching and over $1 billion within four days.

The DEX uses its native token $SUSHI to incentivize liquidity providers to lock up their tokens in liquidity pools including several Uniswap pools. But unlike Uniswap, it gives them full control and voting power over development-based decisions on the protocol.

SushiSwap started off as a smart contract that held user liquidity tokens and which allowed them to tap into the liquidity of several Uniswap pools with a plan to later migrate the smart contract to SushiSwap.

The migration occurred on September 9 2020 with a total of $800 million TVL and benefited both platforms since the best performing liquidity pools were the ones shared by both DEXES.

Yield farming on SushiSwap has been highly lucrative especially due to the ongoing bull market despite expensive fees that yield farmers have to pay in gas to move tokens between multiple eth-based DeFi platforms.

DappRadar noted that the value of Sushi tokens has tripled in the last three months to around $15.75. Additionally, Messari’s Ryan Watkins recently said:

“In January alone, SushiSwap paid Sushi Stakers $6.1 million. Most likely the most fees a protocol has paid out to token holders in a single month ever. Impressive achievement for any DeFi protocol-especially one that’s only 6 months old”.

SushiSwap to Expand Beyond ETH

There are currently over 300 tokens and liquidity pools accessible to users on SushiSwap, including RARI, which recently soared after billionaire Mark Cuban created his first non-fungible token (NFT) on Rarible. The news caused the price of RARI to jump by 59% to its highest price of $5.33 since October 2020.

SushiSwap has also announced a $50K grant to developers interested in building SushiSwap on Ethereum’s rival blockchain ecosystem, Solana.

DeFi News

UK updates its tax policies on DeFI and Staking loans

The UK’s tax authority, Majesty’s Revenue and Customs (HMRC), released an update to its guidance on Wednesday, reported Bloomberg.

The new policy provides a series of “guiding principles” that act as general guidance in determining whether DeFi-related return or participation should be classified as income or capital gain.

How loan returns or staking is taxed depends on whether it is considered capital or income, however determining this can be a complex task. In the post, the HMRC admitted about this difficulty:

Token lending/staking via Decentralized Finance (DeFi) is a constantly evolving area, so it is not possible to establish all the circumstances in which a lender/liquidity provider makes a return on their activities and the nature of that performance. Instead, some guiding principles are established.

New policy to tax DeFi and staking

The latest guide sets out four distinct points designed to make it easier for people to determine the nature of their tax. Firstly, if the return received by the lender or liquidity provider is known “at the time the agreement is made”. If known, it would indicate a revenue receipt, but if unknown, it would indicate a capital receipt.

Second, if the return is realized through the disposal of a capital asset, it qualifies as capital. Conversely, if the borrower, or the DeFi lending platform, pays the yield to the lender/liquidity provider, the yield should be classified as income.

Third, the regulator indicated that lump-sum payments are “more likely” to qualify as principal; while recurring payments are “more likely” to be in the nature of revenue. Finally, the HMRC mentions the loan period as another variable that determines the nature of the repayment, everything will depend on whether it is “fixed or indefinite, short or long term”, he said.

The document presents some examples of how users can determine the nature of their loan return or participation. For example, if the return amount has already been agreed upon, say 5% per annum, it will most likely be a revenue receipt, the regulator said. On the other hand, if the income is “unknown and speculative”, it is probably a capital receipt.

As CoinDesk noted, the new policy is an update to previous guidance that had been published by HMRC in March 2021. According to that document, taxation of staking trades depended on whether the activity amounted to “taxable trading.” The wording closely resembled the established rules for taxing cryptocurrency mining, the outlet adds.

DeFi News

New SEC Definition Includes DeFi Exchanges

The US Securities and Exchange Commission (SEC) is interested in the fact that the definition of a stock market would now be much broader, also encompassing systems that allow buyers and sellers to communicate their interest in trading this type of asset, which which would include decentralized exchanges (DEX) such as Uniswap, PancakeSwap and many others for bringing together this type of people interested in trading digital currencies.

The measure would require platforms that meet these characteristics to register with the US Securities and Exchange Commission as securities brokers, and since decentralized exchanges would not be able to meet the demands required by this type of license, this could imply the imminent cessation of its operations throughout the United States.

More delicate than it seems

Some analysts and enthusiasts express concern about the possible repercussions this could have for the sectors associated with digital currencies.

In this regard, the DeFi sector enthusiast, Gabriel Shapiro, presented an even more delicate panorama for this type of exchange, since such a definition could also address even block explorers, such as Etherscan, precisely because they allow users to users interact with smart contracts to communicate business interests.

In this sense, it highlights that all this can be interpreted as a restriction on freedom of expression, for which it would be completely unconstitutional.

From a regulatory point of view, the SEC commissioner, Hester Peirce, also expressed her concerns and echoed some aspects mentioned above, placing special emphasis on the broad and diffuse nature of the changes proposed by the entity, which even go far beyond the scope and jurisdiction of the regulatory body.

On the other hand, Peirce criticized the fact that the interested community has very little time to read, understand and consider the proposal, which is not consistent with the implications it could have, since it would be making changes to an ecosystem that moves thousands of million dollars, which it could harm in unforeseen ways.

DeFi News

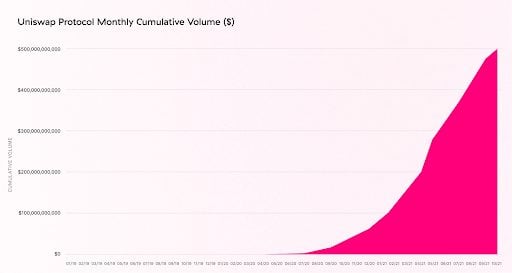

Uniswap exceeds US$500 billion in traded volume since its launch

One of the best-known decentralized exchanges in the cryptocurrency market has just passed the US$500 billion transacted mark.

“We’re proud of the magnitude of this number, but we’re even happier knowing that millions of users have had direct access to markets they could trust were operating in their best interest.” – stated Uniswap Labs on Twitter.

About 2 billion of this volume was thanks to two scalability solutions integrated into the project:

“⚡️ $2 billion of this volume was contributed by @arbitrum and @optimismPBC deployments, which are starting to see significant traction!” – said Uniswap Labs.

Uniswap was created in November 2018, but it was conceived in 2016 by Vitalik Buterin (creator of Ethereum). With support from the Ethereum Foundation, programmer Hayden Adams made the idea come true.

Since then, the broker has not stopped growing and its UNI token is already worth 14.35 billion dollars.

With Uniswap, anyone can be an arbitrator between tokens using the blockchain, which narrows the price gap in small markets and gives incentives to balance asset prices using blockchain and centralized brokerages.

Currently, UNI is traded in several brokers in EEUU and around the world, such as Coinbase, Bitfinex and Binance US.

“We are so grateful to be together on this journey with our incredible community, and we can’t wait to hit the $1tn mark.”

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know