Bitcoin News

Twitter is working on a new bitcoin tipping functionality with the Lightning Network

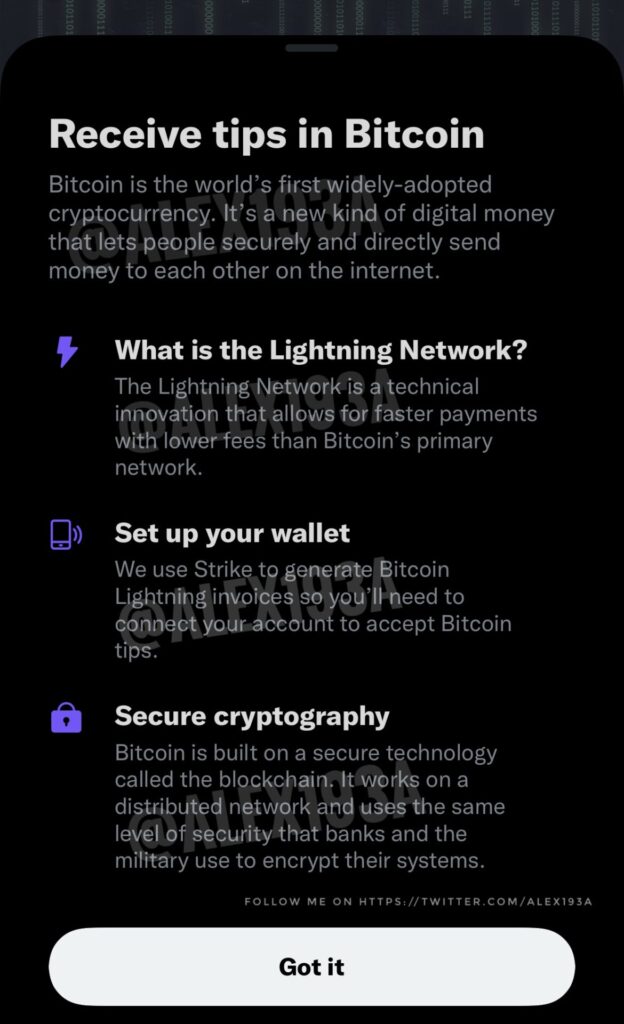

A latest beta version of the popular social platform indicates that users will soon be able to count on a Bitcoin tipping functionality that will work in partnership with Strike.

It appears that soon Twitter users will be able to send and receive Bitcoin tips via the Lightning Network .

According to recent reports, the social media giant led by Bitcoin enthusiast Jack Dorsey (also CEO of Square ) is working to add cryptocurrency tipping functionality to its platform.

According to the MacRumors website , which reports Mac and Apple related news and rumors, the latest beta version of Twitter iOS introduces support for awarding Bitcoin content creators using the “Tip Jar” tipping feature, which Twitter introduced to early this year. In a post yesterday, they detailed that the functionality will leverage the Lightning Network, the second layer solution that facilitates Bitcoin micropayments:

Details in the latest beta version of Twitter indicate that users will be guided through a Bitcoin tutorial that includes details on the Bitcoin Lightning Network and custodial and non-custodial Bitcoin wallets .

For his part, mobile developer Alessandro Paluzzi shared a leaked image showing what Twitter’s new tipping service will look like. Known for revealing mobile app updates in advance, Paluzzi took to Twitter to reveal the information:

Twitter works to add Bitcoin tips

Twitter introduced Tip Jar in May as a way for users to reward content creators on the popular social media platform. If the Bitcoin tip reports are true, then the flagship cryptocurrency will be added along with Cash App, PayPal, and Venmo to the acceptable payment options in Tip Jar.

The leaked image suggests that Twitter is working closely with the Strike app, which is integrated with Lightning, and will use the service to generate Bitcoin invoices. As a result, Twitter users will need a Strike account to receive suggestions. The MacRumors report also confirmed the association with this app.

We use Strike to generate Bitcoin Lightning invoices , so you will need to connect your account to accept Bitcoin suggestions .

The publication also added that the social network has highlighted Strike, Blue Wallet and Wallet of Satoshi as examples of custodial wallets and Muun, Breez , Phoenix and Zap as examples of non-custodial wallets.

Twitter is also reportedly working to add other reactions such as “I’m amused“, “I like it” and “Sad” to its current “I love it” button. However, all of these features are limited to the beta version only and the official release date for the new Bitcoin tipping feature is unknown . The company has also not made an official announcement.

Commitment to Bitcoin

The news about the development of a new function with Bitcoin is not surprising. The CEO of Twitter had already advanced in June the possibility of integrating the social network platform with Lightning Network for a service of this type . ” It’s just a matter of time, ” Dorsey had written when a user suggested the integration.

A Bitcoin tipping feature on Twitter is just the latest in a series of adoption developments focused on the major cryptocurrency for the social media giant, as well as Dorsey himself.

A few days ago, the CEO of Twitter announced plans to build a decentralized exchange (DEX) for Bitcoin. The statements came shortly after Dorsey described Bitcoin as the key to the future of Twitter. He has also advanced his intention for the company to integrate the digital currency in services such as commerce and subscriptions.

On the other hand, Square committed this year to the development of a hardware Bitcoin wallet. The payments company, also led by Dorsey, also has its own dedicated cryptocurrency team, Square Crypto , and has Bitcoin on its balance sheet.

Bitcoin News

Nomura Group Unveils Bitcoin Fund Catering to Institutional Investors

Nomura Digital Assets, a subsidiary of Japan’s leading financial institution, Nomura Group, has ventured into the world of digital assets with the launch of a Bitcoin fund. This strategic move is designed to streamline access to digital assets for major investors, responding to the escalating demand for cryptocurrency investments. It marks Nomura’s maiden foray into providing investment solutions tailored to the digital asset arena.

In a press release dated September 19, Laser Digital Asset Management, the digital asset management arm of Nomura, proudly introduced the Bitcoin Adoption Fund, a specialized offering aimed squarely at institutional investors. This fund underscores the growing breadth of cryptocurrency adoption in Japan.

Facilitating Bitcoin Uptake

The Laser Digital Bitcoin Adoption Fund offers institutional investors an attractive proposition, blending cost-efficiency with robust security measures. In a bid to safeguard the fund’s holdings, Laser has enlisted the services of Komainu, a custody solution established in 2018, which is subject to regulatory oversight and jointly formed by Nomura, Ledger, and Coinshares.

Fiona King, the head of Laser Digital Asset Management, emphasized the fund’s meticulous management and compliance standards. Notably, the fund operates as a segregated portfolio within the mutual fund entity, Laser Digital Funds SPC.

Nomura Holdings foresees that its crypto-focused division, Laser Digital, will begin turning a profit within the next two years. This projection is a response to the surging demand for Bitcoin and other cryptocurrencies, pitting Nomura against established traditional heavyweights such as JPMorgan and Goldman Sachs.

While Laser Digital already offers Bitcoin derivatives to its institutional clientele, the prolonged bear market has impacted the company’s growth trajectory. Due to the recent downturn in cryptocurrency values, Nomura has cautioned that it might take longer than initially anticipated for Laser Digital to achieve profitability.

Bitcoin News

Bitcoin Surges to $32,500 in China: Here’s Why

The cryptocurrency market has witnessed a remarkable surge in the price of Bitcoin, and according to a renowned cryptocurrency analyst, this increase has a fundamental reason: Chinese buying. In a recent YouTube video, the CryptoBanter analyst dissected the factors behind this Bitcoin surge, which comes after a series of significant declines in August. In this report, we will delve into how Chinese buying has propelled the price of Bitcoin and how other factors, such as the depreciation of the Chinese yuan and its correlation with the U.S. Dollar Index (DXY), have influenced this exciting development in the cryptocurrency market.

The Flight from the Chinese Yuan: Bitcoin and Gold as Havens

One of the key factors behind Bitcoin’s recent surge is the increasing flight of Chinese consumers from their national currency. The Chinese currency has experienced depreciation in its value, leading many Chinese individuals to seek refuge in Bitcoin and gold. Economic uncertainty in China, exacerbated by crises in the stock market and the real estate market, has further eroded confidence in the Chinese yuan. As a result, Bitcoin and gold have become safe-haven assets for Chinese investors.

Bitcoin Reaches $32,500 in China

The CryptoBanter analyst reports that the demand for “digital gold” in China has driven Bitcoin’s price to astonishing levels. According to their observations, a single Bitcoin has reached a price of $32,500 in China and was then exchanged for USDT at $33,000. This represents a significant premium compared to the current price of Bitcoin in other markets, which stands at $27,135. This price disparity has created a substantial arbitrage opportunity for investors.

September Breaks the Traditional Bearish Pattern

September is typically a historically bearish month for Bitcoin, but this year has been a notable exception. Despite pessimistic predictions from many analysts, BTC has recorded a 4% increase in its price during this month. The CryptoBanter analyst suggests that this positive performance may foreshadow even greater gains in the future.

Correlation with the U.S. Dollar Index (DXY)

One interesting observation from the analyst is the correlation between the price of Bitcoin and the U.S. Dollar Index (DXY). According to their data, whenever the DXY reaches the level of 105, the price of Bitcoin tends to rise. This could indicate an inverse relationship between the strength of the U.S. dollar and the attractiveness of Bitcoin as an investment asset.

Long-Term Investors Continue to Accumulate

Despite the volatile market conditions, the analyst points out that long-term Bitcoin investors have increased to over 75%. This suggests sustained confidence in the long-term potential of the world’s largest cryptocurrency, even amid price fluctuations.

Bitcoin in the Last 24 Hours

According to CoinMarketCap data, in the last 24 hours, Bitcoin has experienced a 0.79% increase. On the weekly price chart, the leading cryptocurrency has risen by 4.56%. At the time of writing this report, Bitcoin has a market capitalization of $528 billion, solidifying its position as the largest and most robust cryptocurrency network in the world.

In Conclusion…

Chinese buying has proven to be a crucial factor in the recent surge of Bitcoin, challenging the traditionally bearish expectations for September. As the cryptocurrency continues to evolve and attract the attention of investors worldwide, the relationship between Bitcoin and global economic events will remain a topic of interest and discussion within the crypto community.

Bitcoin News

This Analyst Predicts a Bright Bullish Future for Chainlink (LINK)

In an exciting revelation, prominent cryptocurrency analyst Michaël van de Poppe has shared his insightful analysis of Chainlink (LINK), one of the standout cryptocurrencies in today’s market. Van de Poppe, widely recognized in the crypto community, has caused a stir with his bullish predictions for this decentralized oracle network. Let’s delve into the details of his analysis and understand why he foresees a bright future for Chainlink.

Van de Poppe’s Chainlink Analysis

According to Van de Poppe’s analysis, Chainlink has reached its minimum level and is poised for a reevaluation phase that could offer extremely lucrative buying opportunities. His expert view focuses on a specific price range: $6.15 to $6.40. For investors, this range presents itself as a strategic entry point that could result in substantial gains in the near future. Van de Poppe has even set an ambitious price target of $8, suggesting an impressive bullish potential.

Technical Analysis: Bullish Outlook

Chainlink’s technical analysis supports Van de Poppe’s claims. The 4-hour chart for LINK/USD reveals that the altcoin remains above all moving averages, a positive indicator of the current bullish trend. Furthermore, the chart shows that Chainlink is struggling to break above the upper band of its symmetrical triangle pattern, which could mark the beginning of a significant rally.

The MACD indicator also lends support to the idea of a bullish breakthrough, with two consecutive higher highs indicating an upward momentum. Although the RSI remains neutral, it is above the 50 level, suggesting room for further growth in Chainlink’s price.

Key Levels and Resistance

In recent days, bears attempted to push Chainlink’s price below $6.55, but strong buying pressure at this level prevented a significant decline. This demonstrates the strength of buyers in the area. After this attempt at a downward correction, the price returned and reached the supply zone at $6.68. At this point, several double-bottom patterns were observed, a bullish indicator according to technical analysis.

Chainlink’s Potential

The pivotal moment came in the previous 4-hour timeframe when bulls gained momentum by surpassing the resistance at $6.70. This bullish breakthrough led the price to steadily rise, reaching an intraday high of $6.88, which is close to the 200-exponential Moving Average (EMA), a significant technical indicator.

However, as in any financial market, there is always the possibility that bulls may lose their momentum. In that case, we could see a retracement to the main support level at $6.45. If this level fails to hold, a more significant correction to $6.0 is possible, potentially opening the door to a bearish trend.

Conclusion

In summary, Michaël van de Poppe, with his impressive track record of predictions, has put Chainlink on the radar of many investors. His technical analysis supports his bullish outlook and highlights key levels to watch. As this cryptocurrency continues to attract attention in the crypto community, investors will be eager to see if Chainlink lives up to expectations and reaches new highs on its exciting journey towards $8 and beyond. Stay tuned for market updates, as exciting opportunities can arise in the world of cryptocurrencies.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know