Markets

Surging Adoptions, Unsupporting BUSDs, Winning Cases and 20 Crypto Jokes

This week in the cryptoverse, there was a lot of crypto. More specifically: major Ethereum staking providers promised not to own more than 22% of validators, Bitcoin adoption in Argentina was surging, contrasting the more measured approach seen in El Salvador, Shibarium resumed token withdrawals via the bridge, Tether established a banking relationship with Britannia Bank & Trust, Argo Blockchain reduced its total losses to $75 million from last year, and the EOS Network secured whitelist approval from Japan’s regulator allowing EOS to be traded against the yen, Friend.tech lost steam after its splashy debut.

Then, SEBA Bank obtained an approval-in-principle from the SFC in Hong Kong, Robinhood ended its crypto business relationship with Jump Trading, while the former was identified as the third-largest BTC wallet owner, Asia’s richest man Mukesh Ambani was set to invest in blockchain to drive ‘digital adoption in India’, and Prada Group embraced blockchain to combat counterfeit products. OpenZeppelin launched its last blockchain security upgrade Defender 2.0, and Galxe announced the launch of its permissionless self-sovereign identity infrastructure Galxe Protocol.

In Binance news, the exchange decided to delist eight BUSD trading pairs as part of its plan to withdraw support for the stablecoin by 2024, it introduced a new product in Latin America called “Send Cash”, it removed Banco de Venezuela as a payment option from its peer-to-peer services in the country, the head of Binance Asia-Pacific left his position, and Binance was considering a complete withdrawal from the Russian market amid growing Western sanctions. Meanwhile, OKX and Bybit also delisted sanctioned Russian banks from their peer-to-peer services, Coinbase resolved a technical glitch that showed empty balances for some wallets, and Nexo launched a “Dual Mode Crypto Card” to offer debit and credit functionalities for the EEA.

In FTX news, the US DoJ asked a court to reject Sam Bankman-Fried’s planned defense to blame a law firm for the FTX fraud, Bankman-Fried’s attorneys filed a motion seeking his “temporary release”, but the judge denied that request. FTX customers’ info was compromised during the security breach at the bankruptcy claims agent Kroll earlier this month, and phishing attacks escalated for the users following the SIM swap incident.

As this was happening, a class action lawsuit filed against Uniswap was dismissed, Grayscale won its highly anticipated case against the US SEC over the spot Bitcoin ETF application, a US Congressman called for the removal of Gary Gensler as the SEC chair following the Grayscale ruling, US Republican lawmakers accused the Fed of obstructing advancements on the stablecoin bill, and two SEC Commissioners expressed their reservations regarding the agency’s first NFT enforcement action against the media firm Impact Theory. Speaking of NFTs, Cryptoys confirmed that it collaborated with Disney to launch a new collection featuring Mickey Mouse, Minnie, and Pluto, and FirstMate raised $3.75 million for further development of a new NFT storefront builder platform,

In CBDC/mining/won/arrest/job news, Russian banks will have the opportunity to question the Central Bank on its digital ruble pilot next month, Chinese firms and commercial banks were working on new digital yuan supply chain financing solutions, and transport operators in Jamaica expressed interest in using the country’s CBDC for payments. Laos decided to cut the power supply to crypto mining firms due to production concerns, and South Korean crypto exchanges will be required to maintain a reserve fund of at least 3 billion won starting in September. Also in South Korea, prosecutors asked a court to arrest an ex-pro golfer and a top executive at Bithumb. Ben ‘BitBoy’ Crypto was fired from his own company in a ‘coup’, CoinSwitch announced job cuts in its customer support and operations teams, and Clockwork will be winding up its operations as the team steps away from “active development of the protocol”.

Immunefi said that Web3 platforms lost over $1.2 billion this year in hacks and rugs pulls, Balancer was exploited for $900,000 despite a prior vulnerability alert, Ronaldinho failed to show at a parliamentary hearing on crypto pyramids and could face jail time, and a report found that “hundreds of thousands of people” across Southeast Asia are “forced” to engage in crypto scams.

Let the laughter commence!

__________

GM, CT! Or is it CX, now?

__

And once more for people in the back: GM, CT!!!

__

Heey, well done! You’ve made profits.

__

Still pretty in its own way.

__

Absolute lunacy!

__

Pure science.

__

I think we can all agree on this one.

__

Web3 business relationships.

__

Gotta teach them the hard way.

__

Nothing before 4…

__

…but this is allowed before birth.

__

So tempting. It’s just sitting there. Unhacked.

__

Mew.

__

Let’s get this party started!

__

Trust him, he obviously knows what he’s doing.

__

No doubt.

__

The man’s got the solution.

__

Nah. No such thing as too much BTC talk.

__

Here’s a prediction from a world-renowned analyst on counter-SBF possibilities.

__

And lastly, your weekend documentary with expert commentary.

Markets

US National Debt Reaches a Record of $33 Trillion: Economic Crisis in Perspective

The US National Debt has reached a new historic milestone by surpassing the astonishing figure of $33 trillion, according to the most recent fiscal reports. This dizzying increase occurred in less than a year since the debt limit was set at $31.41 trillion in January 2023. This article will analyze the factors behind this unprecedented increase, the role of the debt ceiling, and the implications this has for the American and global economy.

A Limit That Is Constantly Challenged

The debt ceiling is a limit imposed to control how much the U.S. Treasury can actively borrow. It is a crucial tool for maintaining fiscal balance, but throughout history, it has been raised on more than 100 occasions, raising questions about its long-term effectiveness.

Driving Factors of the US National Debt

Several factors contribute to this escalation of the national debt. The response to the COVID-19 pandemic and the assistance provided to Ukraine are significant elements. Additionally, inflation is on the rise, with the United States Consumer Price Index (CPI) reaching a concerning 3.7%. These elements have put pressure on national finances.

The Challenge of Avoiding a Government Shutdown

The United States faces pressure to avoid a government shutdown, as there are only seven legislative days to make crucial decisions. A Defense Appropriations Bill is pending and is considered essential to ensure long-term government funding. However, a collective effort is still required to prevent both a government shutdown and a crisis of the U.S. National Debt.

The Political Perspective

House Minority Leader Hakeem Jeffries points out that the responsibility lies in the hands of the Republicans, but the fight to alleviate the debt burden on American citizens continues. His focus includes pursuing measures that make life more affordable for citizens, cost reduction, creating better-paying jobs, and strengthening communities, among other objectives.

In Conclusion…

The US National Debt has surpassed $33 trillion, marking a historic record and posing significant economic challenges. The decision to raise the debt ceiling once again and the measures taken to address this growing crisis will have a lasting impact on the United States’ economy and its global influence. Time will tell how this situation is resolved and what measures are taken to ensure financial stability in the future.

Markets

These 3 AI Crypto Coins are Bullish in 2023 – Render, Fetch.ai, yPredict

The influence of artificial intelligence (AI) on various sectors is no longer news, and the crypto industry is no exception. In the crypto market, the impact of AI is becoming increasingly evident. AI-centric projects are creating a ripple effect that is influencing the value of their associated cryptocurrencies. Among the multitude of AI-driven initiatives in the crypto space, projects like Render, Fetch.ai, and yPredict are making their presence felt.

As the broader crypto market faces challenges, with Bitcoin struggling to maintain its price above the $25,500 mark, these AI crypto projects offer a glimmer of stability. They present use-cases that extend beyond mere speculation, integrating technological advances into functional, real-world applications.

In a market where many alt coins are finding it hard to sustain their price, these AI-focused tokens offer a promising avenue for future growth. Their impact is not just limited to the crypto market; they have the potential to drive advancements across various sectors, from entertainment to finance and beyond.

The Rendering Revolution: What Makes Render a Noteworthy AI Crypto Project

Render focuses on providing solutions for GPU-based rendering. The project makes the complicated process of converting 2D or 3D computer models into lifelike images more accessible. By allowing people to use their idle GPUs to complete rendering tasks, the platform democratizes the cloud rendering process.

The project was founded by Jules Urbach, who is also known for founding OTOY, a company specializing in cloud rendering services. Another key player in the project is Ari Emmanuel, who currently serves as the co-founder and co-CEO.

According to their distribution plan, 25% of the native Render Token (RNDR) is open to the public, 10% is being kept in reserve, and the remaining 65% is set aside for network operations. The RNDR token plays a central role in the platform’s economy, as it is used to pay for rendering and streaming services.

A recent blog post by the Render team outlined the primary use cases of the RNDR token. These include protecting rights, monetizing content, and empowering individual creators. Users who offer rendering services on the platform can earn RNDR tokens, which can be bought, sold, and held as an investment on various crypto exchanges.

The Automation Advantage: Fetch.ai’s Role in the AI Crypto Sector

Fetch.ai is another player in the AI crypto arena, simplifying daily tasks through AI and blockchain. The platform uses something called a ‘digital twin,’ a virtual bot that represents you and can perform tasks like comparing flight prices across different websites.

These digital twins can also learn and share experiences with each other. For example, if you want to plan a vacation similar to one your friend enjoyed, the digital twins can negotiate the details, sparing you the need for exhaustive research.

Fetch.ai is not just for personal tasks; it’s also finding a role in decentralized finance (DeFi). Within the crypto market, it can identify tokens that are cheaper on one exchange than another and execute purchases on your behalf.

The native token of the platform, FET, serves multiple purposes. It fuels the internal economy of the platform and is used to access various services. Staking FET tokens not only earns interest but also grants users a say in the platform’s future. Requiring FET tokens to deploy a digital twin acts as a safeguard against spam and malicious bots.

yPredict: A New Chapter in AI-Driven Crypto Analysis

While yPredict is still in its presale stage, it has already attracted a significant amount of interest. The platform has raised over $3.81 million of its targeted $4.6 million, with each YPRED token priced at $0.1. Built on the Polygon Matic chain, yPredict will work with YPRED tokens that have a multitude of uses within the platform.

One of the main features of yPredict will be its prediction marketplace. Here, financial data scientists can offer their predictive models as a subscription service. Traders can then subscribe to these models using YPRED tokens, gaining access to valuable trading signals and forecasts. The setup allows data scientists to monetize their predictive models without having to manage trading operations.

In addition to the prediction marketplace, YPRED tokens will be used for other functions, like analyzing various cryptocurrencies and gaining access to data-driven insights. Token holders can also stake their tokens in high-yield pools, which derive their liquidity from 10% of each new user’s YPRED deposit.

Understanding yPredict’s tokenomics will be important for those who plan to use the platform. The total supply of YPRED tokens is set at 100 million, with 80 million allocated for the presale. The remaining tokens are reserved for liquidity and development purposes.

Beyond their utility in the marketplace, YPRED tokens will allow holders to participate in voting processes, contributing to the decision-making within the yPredict ecosystem.

yPredict plans to offer more than just price predictions. The platform will also feature a range of analytical tools, including pattern recognition, sentiment analysis, and transaction analysis. These tools will automatically detect chart patterns, analyze news and social media content related to the asset under consideration, and generate useful data-driven insights.

Adding to its trading focus, yPredict is also developing an AI-powered backlink estimator. The tool is trained on over 100 million links and will predict the backlink profile needed for a site to rank for a specific keyword.

Initially launched as a free preview, the feature received over 5,000 requests within the first 24 hours. It’s now available to the public at a price of $99 per query, according to a recent tweet from yPredict’s official account.

In summary, as the crypto market faces uncertainty, AI-driven projects like Render, Fetch.ai, and the soon-to-be-launched yPredict offer a glimpse of stability and practical utility. These platforms are not just about speculation; they work to solve real-world problems, extending their influence beyond the volatile crypto market.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Markets

Bitcoin Price Prediction as Crypto Market Selling Continues – What’s Going On?

Amid a continued selling trend in the crypto market, Bitcoin‘s value experiences notable fluctuations. As of now, the live price of Bitcoin stands at $25,090, with an impressive 24-hour trading volume of $14.7 billion.

However, despite its market dominance—reflected in its #1 ranking on CoinMarketCap—Bitcoin has seen a dip of nearly 3% in the past 24 hours.

The currency’s live market capitalization is a whopping $488.83 billion, and out of its maximum supply of 21 million BTC coins, 19,482,656 BTC are currently in circulation.

The pressing question on everyone’s mind is: What’s causing this market upheaval?

Bitcoin Price Prediction

Delving into the technical analysis of Bitcoin, it is evident that the premier cryptocurrency has recently witnessed a stark downturn.

Specifically, it has breached a significant triple bottom support at the $25,400 level—a benchmark that had been underscored by the triple bottom pattern visible on the 4-hour timeframe.

The presence of the “Three Black Crows” candlestick pattern on this same timeframe further augments the prospects of a continued bearish trend.

Presently, Bitcoin is navigating the oversold territory. Oscillator indicators, like the Relative Strength Index (RSI), are lingering below the 30 mark, which typically suggests seller exhaustion.

Such a dynamic often paves the way for a brief bullish correction prior to a potential resumption of the downtrend. Concurrently, the Moving Average Convergence Divergence (MACD) indicator has entrenched itself in the sell zone, with histograms forming below the zero line—another beacon of bearish sentiment.

The 50-day Exponential Moving Average (EMA) is positioned around $25,500, and with Bitcoin currently priced at approximately $25,200, and consistently trading below the 50 EMA, the bearish bias remains robust.

From this technical analysis point, Bitcoin is poised to encounter resistance around the $25,400 level.

A modest bullish correction up to the $25,600 level might merely be a precursor to a deeper dive, potentially targeting the next support level at $24,800.

If Bitcoin was to decisively undercut the $24,800 level, the subsequent support is anticipated around the $24,000 mark. It’s also worth noting a descending trend line, currently posing as a significant barrier around the $25,600 mark.

However, should Bitcoin muster a bullish breakout above this line, the gates might open for a rally towards the $26,400 level or even as high as $46,000.

In summation, the $25,600 level emerges as a critical juncture, likely serving as today’s pivotal point in the trading landscape.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

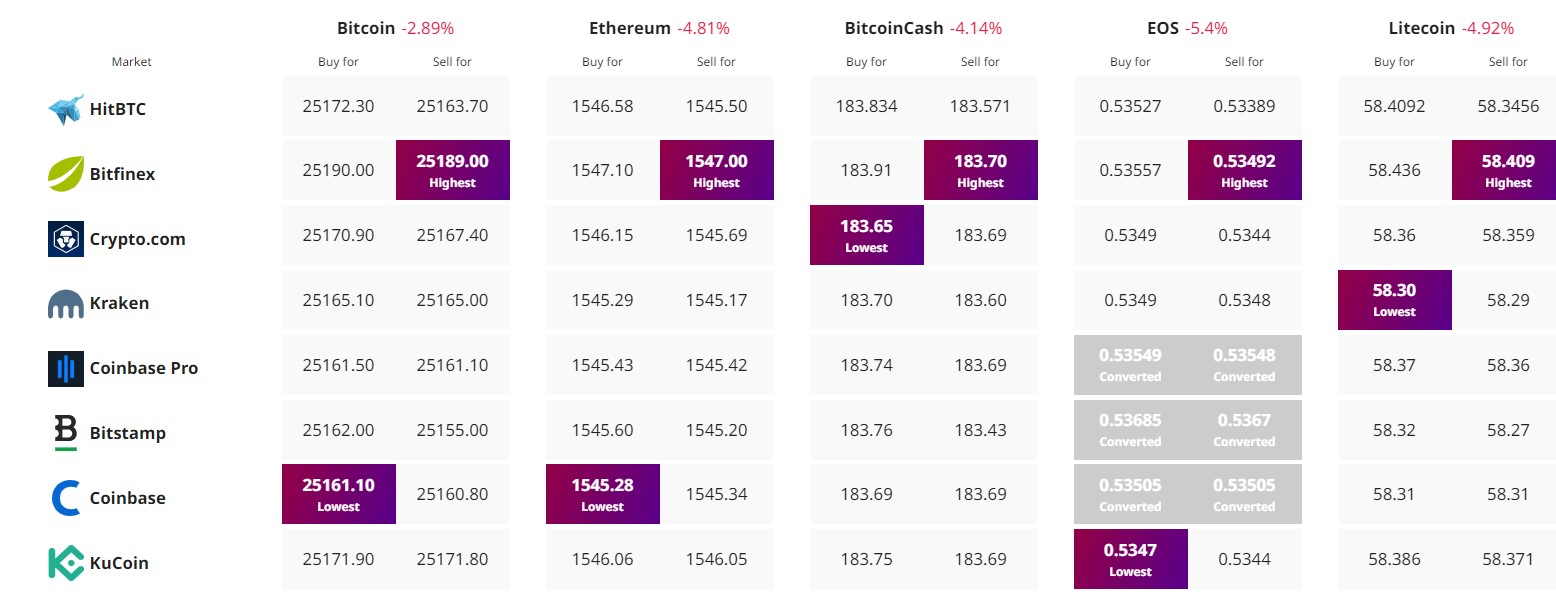

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know