Markets

Best Crypto to Buy Today 26 January – MEMAG, APT, FGHT, MINA, CCHG

January has been a kind month to the crypto market, with Bitcoin and Ethereum seeing substantial gains while many altcoins continue to bounce hard from 2022 lows. Bitcoin recently rose to a January peak of $23,501 before rebounding slightly to its present value at $23,180 as of writing.

This represents an increase of 0.53% on the day and more than 9.55% over the past week. Ethereum has also seen gains, currently trading at $1,614, up 3.5% for the day and 6.5% for the week.

The industry’s two largest cryptocurrencies by market capitalization have also seen a cumulative trading volume of more than $56 billion in the past 24 hours, surpassing the $53 billion posted by stablecoin Tether. Many in the market are wondering if this is the start of a larger bull run or if another correction is on the horizon.

The overall crypto market capitalization is currently holding steady above $1 trillion after reclaiming the level on January 20. However, it’s still ways away from its peak in November 2021 when it reached over $3 trillion.

Traders and investors are advised to implement risk management strategies for capital preservation and keep their expectations in check as the cryptocurrency market isn’t completely out of the woods yet.

Five cryptos that look attractive amid this current market condition are MEMAG, APT, FGHT, MINA, and CCHG, which are all potential buys right now based on fundamental and/or technical indicators.

Meta Masters Guild (MEMAG) is One of the Best Cryptos to Buy Today

Meta Masters Guild (MEMAG) is bringing some interesting ideas to the Web3 gaming space with its upcoming “Web3 gaming guild” focused on creating a trans-game economy centered around a community-focused metaverse world that ties various mobile games together in different genres.

By combining blockchain technology and a decentralized community, MMG is taking gaming one step further. They’re determined to create an engaging environment that encourages both entertainment and connection while solving modern problems gamers come across.

Besides a roster of high-caliber games, the project will also integrate NFTs and crypto rewards. MMG is being created to recognize players for their commitment and dedication in the games that will soon be available, granting them MEMAG cryptocurrency as well as control of several aspects within the game. Through an open-ended economy system, players can swap digital inventory and currency with Gems rewards that can be exchanged into real money or NFT items inside the games.

To kick off the Web3 gaming community, they have developed Meta Kart Racers–a thrilling racing game with two modes: Player vs Player and single-player–that everyone can access on their mobile device.

MMG has more Web3 games up its sleeve already in development as well that are set to be launched into the Meta Masters Guild ecosystem.

Cryptocurrency traders have been flocking to take part in MMG’s MEMAG token presale launch, resulting in a hefty $1.45 million raised in a matter of weeks.

Aptos (APT)

Aptos is currently experiencing a strong bullish trend, with the price setting an all-time high of $20.40 earlier in today’s trading session. The 20-day and 50-day exponential moving averages (EMAs) are both trading below the current price, indicating that the short and medium-term trend is bullish.

The RSI is also indicating a strong bullish trend, with a reading of 89.61, as is the MACD indicator, with the previous day’s MACD histogram being higher than the current day’s.

APT is currently supported by the Fibonacci extended level of FIB 1.272 at $17.74, and if it successfully breaches the psychological barrier of $20, its next potential target would be FIB 1.618 at $21.73.

There are several reasons why Aptos is currently experiencing an upward trend. Firstly, the company hosted its first AptosMoveMonday of 2023 on January 9, which roughly coincided with the upward move in the price of $APT. Its co-founders actively answered a number of questions and discussed many upcoming developments during the session.

Additionally, on January 20, Binance announced the opening of two new liquidity pools for Aptos, with $APT/BTC and $APT/USDT. This helped drive the price and trading volume for $APT even further. In addition to these announcements, the increased trading activity and attention Aptos is receiving due to its rally are causing a snowball effect as traders FOMO into the crypto.

Although Aptos could still be a buy, other cryptos such as Fight Out may have more potential upside, as Aptos begins to experience a pullback today.

Fight Out (FGHT)

Fight Out, a soon-to-launch gym chain and innovative move-to-earn fitness app built on Web3 technology, plans to bring the community and high-tech solutions to the fitness industry while providing users with exclusive workout programs fit for their individual needs.

Those who persevere in achieving their health goals with the app will be rewarded with REPS tokens–not only boosting motivation but also enabling them to make money as they maintain a healthy lifestyle. The M2E application is being developed by an expert team of professionals prequalified through CoinSniper’s rigorous vetting process.

Fight Out is shaking up the fitness industry with their cutting-edge gyms that will be equipped with interactive features like “mirrors” to show off user profiles and utilize sensors for real time guidance on exercises–making going to the gym far more enjoyable. To top it all off, Fight Out has brought in well known athletes such as Amanda Ribas from UFC and Savannah Marshall, a former WBO middleweight champion into its ambassador program.

Fight Out is primed to become a major player in the fitness app and fitness chain industry in the years ahead. Investing now in Fight Out’s presale event–with bonuses up to 50% on investments over $50K–is a good chance to get in on the ground floor of the project.

Already more than $3.48 million has been raised, proving this project doesn’t lack momentum as its launch approaches. Step into the ring and make your move before stage 2 begins and token prices rise.

Mina Protocol (MINA)

MINA is an altcoin that has seen a significant price increase in yesterday’s candle close, with a 22.36% gain. The Mina Protocol aims to be a lightweight and nimble option for blockchain developers, with a constant size of no more than 22 kB.

The reason for MINA’s current price uptrend is not clear, but it appears to be part of a broader market rally and the anticipation of a potential drop in interest rates by the Federal Reserve.

Currently, MINA is trading at $0.671 with a 1.90% decrease in value for the day. It retested the 200-day EMA earlier in today’s trading session and it posted an intra-day high of $0.770

Its immediate support is around the support area of $0.581 to $0.603 while its immediate resistance is the area between $0.773 to $0.815 in confluence with the 200-day EMA at $0.76. If the price successfully reclaims this level, the next potential target is the psychological resistance of $1.

With its Real Utility C+Charge (CCHG) is One of the Best Cryptos to Buy Today

C+Charge is looking to drive change in the EV charging market with its groundbreaking peer-to-peer payment system and rewards program utilizing blockchain technology. The platform will reward electric vehicle owners with carbon credit crypto while helping them access charge stations and process payment transactions faster–giving them an easy and secure way to power up their cars.

For electric vehicle owners searching for a dependable and seamless way to find charge stations and monitor and verify their charging sessions, C+Charge will be a great option.

With the presale now underway, this is your opportunity to get C+Charge’s sustainable crypto tokens, CCHG, at the introductory rate of $0.013 USDT per token before they are priced up in three stages and reach their final cost of $0.02350.

Markets

US National Debt Reaches a Record of $33 Trillion: Economic Crisis in Perspective

The US National Debt has reached a new historic milestone by surpassing the astonishing figure of $33 trillion, according to the most recent fiscal reports. This dizzying increase occurred in less than a year since the debt limit was set at $31.41 trillion in January 2023. This article will analyze the factors behind this unprecedented increase, the role of the debt ceiling, and the implications this has for the American and global economy.

A Limit That Is Constantly Challenged

The debt ceiling is a limit imposed to control how much the U.S. Treasury can actively borrow. It is a crucial tool for maintaining fiscal balance, but throughout history, it has been raised on more than 100 occasions, raising questions about its long-term effectiveness.

Driving Factors of the US National Debt

Several factors contribute to this escalation of the national debt. The response to the COVID-19 pandemic and the assistance provided to Ukraine are significant elements. Additionally, inflation is on the rise, with the United States Consumer Price Index (CPI) reaching a concerning 3.7%. These elements have put pressure on national finances.

The Challenge of Avoiding a Government Shutdown

The United States faces pressure to avoid a government shutdown, as there are only seven legislative days to make crucial decisions. A Defense Appropriations Bill is pending and is considered essential to ensure long-term government funding. However, a collective effort is still required to prevent both a government shutdown and a crisis of the U.S. National Debt.

The Political Perspective

House Minority Leader Hakeem Jeffries points out that the responsibility lies in the hands of the Republicans, but the fight to alleviate the debt burden on American citizens continues. His focus includes pursuing measures that make life more affordable for citizens, cost reduction, creating better-paying jobs, and strengthening communities, among other objectives.

In Conclusion…

The US National Debt has surpassed $33 trillion, marking a historic record and posing significant economic challenges. The decision to raise the debt ceiling once again and the measures taken to address this growing crisis will have a lasting impact on the United States’ economy and its global influence. Time will tell how this situation is resolved and what measures are taken to ensure financial stability in the future.

Markets

These 3 AI Crypto Coins are Bullish in 2023 – Render, Fetch.ai, yPredict

The influence of artificial intelligence (AI) on various sectors is no longer news, and the crypto industry is no exception. In the crypto market, the impact of AI is becoming increasingly evident. AI-centric projects are creating a ripple effect that is influencing the value of their associated cryptocurrencies. Among the multitude of AI-driven initiatives in the crypto space, projects like Render, Fetch.ai, and yPredict are making their presence felt.

As the broader crypto market faces challenges, with Bitcoin struggling to maintain its price above the $25,500 mark, these AI crypto projects offer a glimmer of stability. They present use-cases that extend beyond mere speculation, integrating technological advances into functional, real-world applications.

In a market where many alt coins are finding it hard to sustain their price, these AI-focused tokens offer a promising avenue for future growth. Their impact is not just limited to the crypto market; they have the potential to drive advancements across various sectors, from entertainment to finance and beyond.

The Rendering Revolution: What Makes Render a Noteworthy AI Crypto Project

Render focuses on providing solutions for GPU-based rendering. The project makes the complicated process of converting 2D or 3D computer models into lifelike images more accessible. By allowing people to use their idle GPUs to complete rendering tasks, the platform democratizes the cloud rendering process.

The project was founded by Jules Urbach, who is also known for founding OTOY, a company specializing in cloud rendering services. Another key player in the project is Ari Emmanuel, who currently serves as the co-founder and co-CEO.

According to their distribution plan, 25% of the native Render Token (RNDR) is open to the public, 10% is being kept in reserve, and the remaining 65% is set aside for network operations. The RNDR token plays a central role in the platform’s economy, as it is used to pay for rendering and streaming services.

A recent blog post by the Render team outlined the primary use cases of the RNDR token. These include protecting rights, monetizing content, and empowering individual creators. Users who offer rendering services on the platform can earn RNDR tokens, which can be bought, sold, and held as an investment on various crypto exchanges.

The Automation Advantage: Fetch.ai’s Role in the AI Crypto Sector

Fetch.ai is another player in the AI crypto arena, simplifying daily tasks through AI and blockchain. The platform uses something called a ‘digital twin,’ a virtual bot that represents you and can perform tasks like comparing flight prices across different websites.

These digital twins can also learn and share experiences with each other. For example, if you want to plan a vacation similar to one your friend enjoyed, the digital twins can negotiate the details, sparing you the need for exhaustive research.

Fetch.ai is not just for personal tasks; it’s also finding a role in decentralized finance (DeFi). Within the crypto market, it can identify tokens that are cheaper on one exchange than another and execute purchases on your behalf.

The native token of the platform, FET, serves multiple purposes. It fuels the internal economy of the platform and is used to access various services. Staking FET tokens not only earns interest but also grants users a say in the platform’s future. Requiring FET tokens to deploy a digital twin acts as a safeguard against spam and malicious bots.

yPredict: A New Chapter in AI-Driven Crypto Analysis

While yPredict is still in its presale stage, it has already attracted a significant amount of interest. The platform has raised over $3.81 million of its targeted $4.6 million, with each YPRED token priced at $0.1. Built on the Polygon Matic chain, yPredict will work with YPRED tokens that have a multitude of uses within the platform.

One of the main features of yPredict will be its prediction marketplace. Here, financial data scientists can offer their predictive models as a subscription service. Traders can then subscribe to these models using YPRED tokens, gaining access to valuable trading signals and forecasts. The setup allows data scientists to monetize their predictive models without having to manage trading operations.

In addition to the prediction marketplace, YPRED tokens will be used for other functions, like analyzing various cryptocurrencies and gaining access to data-driven insights. Token holders can also stake their tokens in high-yield pools, which derive their liquidity from 10% of each new user’s YPRED deposit.

Understanding yPredict’s tokenomics will be important for those who plan to use the platform. The total supply of YPRED tokens is set at 100 million, with 80 million allocated for the presale. The remaining tokens are reserved for liquidity and development purposes.

Beyond their utility in the marketplace, YPRED tokens will allow holders to participate in voting processes, contributing to the decision-making within the yPredict ecosystem.

yPredict plans to offer more than just price predictions. The platform will also feature a range of analytical tools, including pattern recognition, sentiment analysis, and transaction analysis. These tools will automatically detect chart patterns, analyze news and social media content related to the asset under consideration, and generate useful data-driven insights.

Adding to its trading focus, yPredict is also developing an AI-powered backlink estimator. The tool is trained on over 100 million links and will predict the backlink profile needed for a site to rank for a specific keyword.

Initially launched as a free preview, the feature received over 5,000 requests within the first 24 hours. It’s now available to the public at a price of $99 per query, according to a recent tweet from yPredict’s official account.

In summary, as the crypto market faces uncertainty, AI-driven projects like Render, Fetch.ai, and the soon-to-be-launched yPredict offer a glimpse of stability and practical utility. These platforms are not just about speculation; they work to solve real-world problems, extending their influence beyond the volatile crypto market.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Markets

Bitcoin Price Prediction as Crypto Market Selling Continues – What’s Going On?

Amid a continued selling trend in the crypto market, Bitcoin‘s value experiences notable fluctuations. As of now, the live price of Bitcoin stands at $25,090, with an impressive 24-hour trading volume of $14.7 billion.

However, despite its market dominance—reflected in its #1 ranking on CoinMarketCap—Bitcoin has seen a dip of nearly 3% in the past 24 hours.

The currency’s live market capitalization is a whopping $488.83 billion, and out of its maximum supply of 21 million BTC coins, 19,482,656 BTC are currently in circulation.

The pressing question on everyone’s mind is: What’s causing this market upheaval?

Bitcoin Price Prediction

Delving into the technical analysis of Bitcoin, it is evident that the premier cryptocurrency has recently witnessed a stark downturn.

Specifically, it has breached a significant triple bottom support at the $25,400 level—a benchmark that had been underscored by the triple bottom pattern visible on the 4-hour timeframe.

The presence of the “Three Black Crows” candlestick pattern on this same timeframe further augments the prospects of a continued bearish trend.

Presently, Bitcoin is navigating the oversold territory. Oscillator indicators, like the Relative Strength Index (RSI), are lingering below the 30 mark, which typically suggests seller exhaustion.

Such a dynamic often paves the way for a brief bullish correction prior to a potential resumption of the downtrend. Concurrently, the Moving Average Convergence Divergence (MACD) indicator has entrenched itself in the sell zone, with histograms forming below the zero line—another beacon of bearish sentiment.

The 50-day Exponential Moving Average (EMA) is positioned around $25,500, and with Bitcoin currently priced at approximately $25,200, and consistently trading below the 50 EMA, the bearish bias remains robust.

From this technical analysis point, Bitcoin is poised to encounter resistance around the $25,400 level.

A modest bullish correction up to the $25,600 level might merely be a precursor to a deeper dive, potentially targeting the next support level at $24,800.

If Bitcoin was to decisively undercut the $24,800 level, the subsequent support is anticipated around the $24,000 mark. It’s also worth noting a descending trend line, currently posing as a significant barrier around the $25,600 mark.

However, should Bitcoin muster a bullish breakout above this line, the gates might open for a rally towards the $26,400 level or even as high as $46,000.

In summation, the $25,600 level emerges as a critical juncture, likely serving as today’s pivotal point in the trading landscape.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

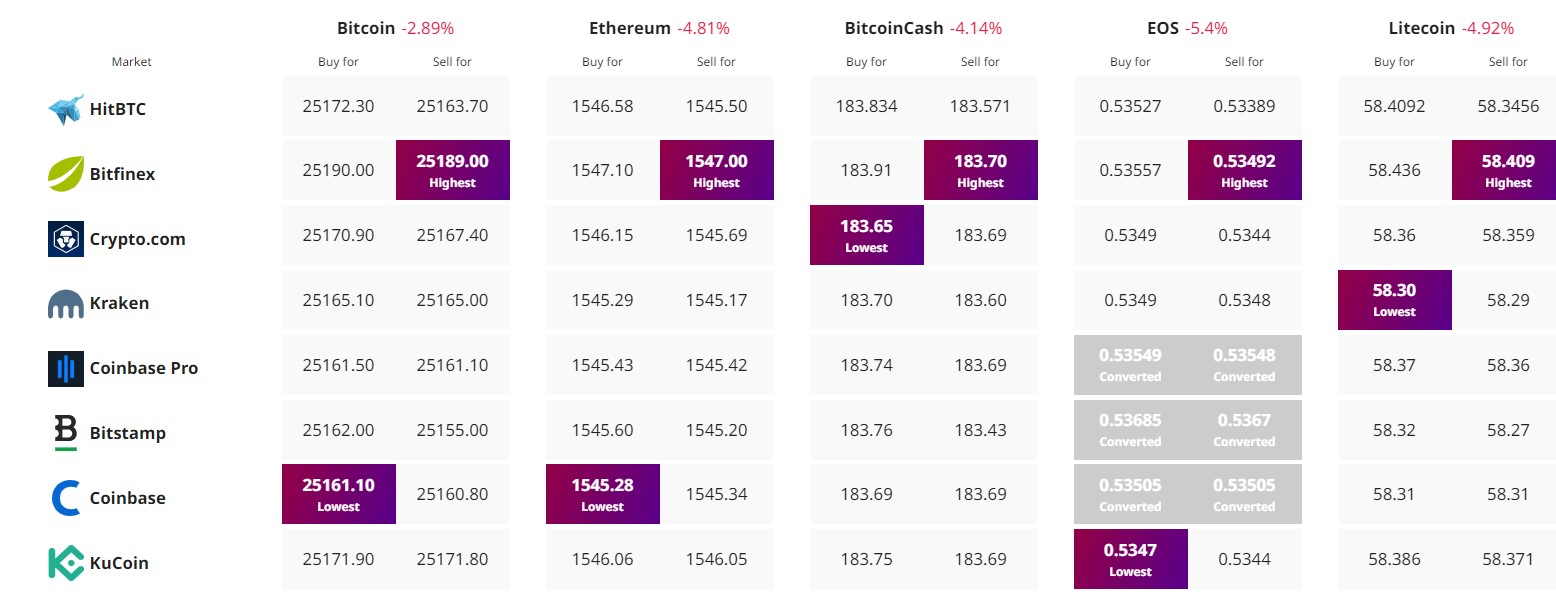

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know