Markets

Best Crypto to Buy Now September 7 – THORChain, Toncoin, Render

Two leading exchange-traded fund (ETF) providers have set their sights on launching the first spot Ethereum ETF in the U.S. after continued delays from regulators on approving a spot Bitcoin ETF.

ARK Invest and asset manager VanEck filed proposals with the Securities and Exchange Commission (SEC) for Ethereum ETFs that would trade on CBOE Global Markets’ BZX Exchange.

Considering the current developments in crypto ETFs, what are the best cryptos to buy now?

The move comes just days after the SEC pushed back its deadline to approve or deny several spot Bitcoin ETF applications from asset managers like Valkyrie, Invesco, and WisdomTree.

“This kicks off the official race to launch the first U.S. spot Ether ETF,” said Bloomberg Intelligence ETF analyst James Seyffart, who predicts a decision on the newly filed Ethereum ETF applications by May 2024.

The SEC has repeatedly delayed approving any spot crypto ETFs over concerns around price volatility, valuation, liquidity, and potential manipulation in the underlying assets. The regulator has only allowed ETFs based on bitcoin futures to come to market so far.

However, proponents argue that the market has matured significantly, pointing to growing adoption, regulated crypto exchanges, and a market cap of over $1 trillion.

The SEC’s continued resistance recently led Grayscale, the world’s largest digital asset manager, to sue the regulator for denying its Bitcoin ETF application.

Earlier this month, a federal appeals court ruled that the SEC must reexamine Grayscale’s proposed Bitcoin ETF after incorrectly applying standards on manipulation risk and investor protection.

While the decision marked a small victory for the industry, the outcome of the SEC’s review remains uncertain.

With regulators still hesitant on spot Bitcoin ETFs, providers seem ready to shift focus to Ethereum as the next best alternative.

Though less established than Bitcoin, Ethereum is the second largest cryptocurrency with a market cap of approximately $200 billion.

ProShares, the company behind the first U.S. Bitcoin futures ETF, said it may also pivot to an Ethereum futures ETF if spot bitcoin continues to face regulatory pushback.

With major players like BlackRock and Fidelity expressing interest in crypto offerings, asset managers appear determined to bring investment exposure to U.S. investors one way or another.

The SEC has until mid-October to approve or deny pending spot Bitcoin ETF applications. But based on its history of pushing back decisions and rejecting most filings thus far, there is skepticism that spot Bitcoin ETFs will get approved anytime soon.

This latest pivot to Ethereum by major issuers signals that the industry remains resilient and will continue seeking regulated investment products for investors to gain cryptocurrency exposure.

Based on the current state of the cryptocurrency market, THORChain, Wall Street Memes, Toncoin, Bitcoin BSC, and Render stand out as some of the best cryptos to buy now thanks to their robust fundamentals and/or favorable technical analysis.

Traders Anticipate THORChain’s (RUNE) Next Move: Breakout or Breakdown?

The recent price action of THORChain (RUNE) shows that it is on an upward trend for the third day in a row.

After bouncing back from the Fib 0.5 level at $1.469 and finding support at the 20-day EMA ($1.495), it is now seeking to break through the Fib 0.382 level at $1.601.

Alongside this, the coin is showing signs of a symmetrical triangle pattern, often seen during periods of price consolidation. Adding to this, trading volume has been dropping, which is common before a price breakout or breakdown.

Regarding other technical indicators, the 20-day EMA stands at $1.495, while the 50-day and 100-day EMAs are at $1.350 and $1.264, respectively. This suggests a general bullish trend as the shorter-term EMA is above the longer-term ones.

The RSI has increased from 57.85 to 59.27, indicating that the cryptocurrency is neither overbought nor oversold. The MACD histogram also shows a slight positive change, moving from -0.021 to -0.016.

RUNE is currently priced at $1.591, with a 1.66% increase so far today. Looking at resistance levels, $1.601 is the first target, followed by a more formidable resistance zone ranging from $1.666 to $1.731.

A successful breakout from these levels could lead to retests at even higher resistances of $1.765 and potentially $2.029.

On the downside, the 20-day EMA ($1.495) acts as immediate support, followed by the Fib 0.5 level of $1.469 and an ascending trendline support at $1.449.

If RUNE’s price falls below the ascending trendline, it might lead to a symmetrical triangle breakdown, potentially triggering a move toward the next support zone between $1.290 to $1.363.

In the immediate future, traders should closely watch for a breakout or breakdown from the symmetrical triangle formation to determine RUNE’s next directional move.

WSM: The Highly-Anticipated 2023 Meme Coin Launch with a Million-Strong Community

Wall Street Memes has seen significant interest in its presale phase. Over the past few months, the presale has attracted more than $25 million from early supporters.

This popularity sets high expectations for its upcoming launch on a centralized exchange (CEX) in less than 20 days.

WSM has managed to grab attention with its large community, which now boasts more than a million supporters. This strong community base has contributed to the project becoming one of the most anticipated coin launches for the third quarter of 2023.

Interestingly, the project is inspired by the Wall Street Bets community, which has been known for its anti-bank stance. WSM seeks to convert this sentiment into a cryptocurrency.

The coin’s affordable price point of $0.0337 has also attracted a significant number of early backers. This democratic pricing, coupled with the $25 million raised in the presale, has made WSM one of the best cryptos to buy for many investors.

Additionally, early investors stand to gain an extra 30% upon the initial listing, a feature that has sparked further interest.

One notable occurrence was the investment of $1 million by an unidentified crypto whale. The investment, made in August, was broken down into five transactions totaling 460 ETH, valued at $840,000, carried out within a span of six minutes.

A further 93 ETH had been invested by the same wallet two weeks prior. This large investment has been viewed as a show of confidence in the potential return on investment for WSM.

WSM’s tokenomics places a strong emphasis on community rewards, with 30% of the token supply allocated for this purpose. Additionally, 20% is set aside for liquidity, and 50% is available in the presale.

This community-centric approach has also contributed to its rapid growth on social media platforms.

Transitioning from its roots, inspired by the Wall Street Bets community, WSM is looking to make a significant impact on the crypto market.

The project has already shown signs of strong community support and financial backing, making it a contender for one of the best crypto to buy in the coming months.

TON: Price Consolidation at Fibonacci Support Signals Potential Rebound

After pulling back from a near two-week upward trend, TON is currently hovering around the Fib 0.236 level at $1.8084. This price level could serve as a potential support, indicating a likely area for price consolidation before TON’s next move.

TON’s 20-day EMA currently stands at $1.6663, which is above the 50-day EMA of $1.53 and the 100-day EMA of $1.5565.

This implies that the immediate trajectory for TON has been predominantly positive. Nonetheless, traders need to watch if the price sustains above these Exponential Moving Averages (EMAs). Any decline beneath them could potentially indicate an impending bearish trend.

TON’s RSI remains virtually the same, standing at 65.06 compared to the previous day’s 65.08. Generally, an RSI surpassing 70 is interpreted as an overbought scenario, while a figure under 30 signifies an oversold situation.

As TON hovers close to the overbought threshold, there’s a potential for further pullback in the near future.

Meanwhile, the MACD histogram has slightly decreased to 0.0138 from yesterday’s 0.0221. While this indicates a decrease in bullish momentum, the MACD line still remains above the signal line, which may indicate that the cryptocurrency remains in a general uptrend.

TON is currently trading at $1.8046, down by 0.86% so far today. It faces immediate resistance at a swing high of $1.98, in line with the psychological resistance level of $2. If it crosses this resistance, the next zone to watch would be between $2.0332 and $2.0822.

On the downside, TON finds immediate support in a horizontal zone ranging from $1.7686 to $1.8334, which also aligns with the Fib 0.236 level at $1.8084. This region could serve as a zone where TON may stabilize before its next price move.

Bitcoin BSC: Finding Real-World Utility in One of the Best Cryptos to Buy Now

Bitcoin BSC seeks to bring more than just hype to the crypto market. With features like staking rewards, low transaction fees, and quick transaction speeds, BTCBSC is focusing on long-term value.

Staking is a feature that lets token holders earn rewards, and it’s one of the core offerings of BTCBSC.

The token operates on the Binance Smart Chain (BSC) and has a reward distribution plan that spans 120 years, aligning with Bitcoin block confirmations.

With 69% of its total token supply of 21 million set aside for rewards, BTCBSC is attracting interest from investors.

Staking in BTCBSC is operational even before its official listing on the decentralized exchange PancakeSwap.

BTCBSC has outlined a four-stage roadmap focused on creating lasting value within the Binance Smart Chain ecosystem.

The presale phase, set for the third quarter of 2023, will offer 29% of the total token supply at $0.99. Funds from the presale will be used for the project’s development and marketing.

Following the presale, staking will be activated to encourage early participation.

The official token launch is planned for the fourth quarter of 2023 on a Binance Smart Chain Decentralized Exchange.

2% of the total token supply will be used to provide liquidity, ensuring the project’s decentralization and community ownership.

In the final stage, BTCBSC will focus on passive income opportunities. Starting in the fourth quarter of 2023, token holders can stake their tokens for daily payouts.

This stage is designed to provide stability and positive returns to network participants, strengthening its case as one of the best cryptos to buy now.

By offering a clear roadmap and features like staking, BTCBSC is carving out a niche for itself as a more practical and potentially reliable crypto option than other staking coins.

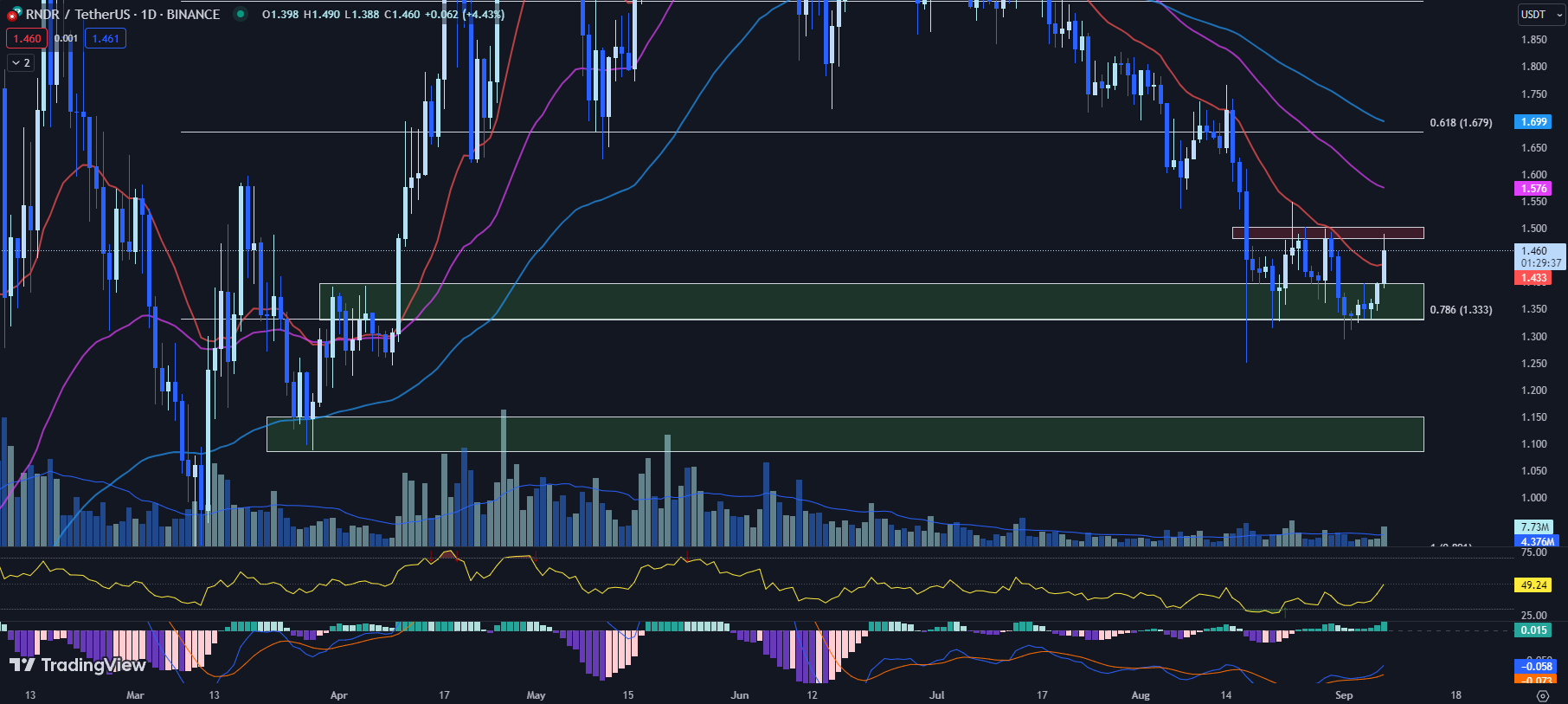

RNDR Makes Strides: Retaking Resistance Levels and Eyeing a Potential Trend Reversal

Render (RNDR) is showing some signs of potential change in its price action. After 53 days of struggling to move above its 20-day EMA, the cryptocurrency is currently trading above this level at a price of $1.460.

Should RNDR manage to close above the 20-day EMA of $1.433 in today’s trading session, this could suggest a possible trend reversal.

When it comes to technical indicators, the 50-day EMA stands at $1.576 and the 100-day EMA is at $1.699. These levels could serve as resistance if the price continues to move upward.

Meanwhile, RNDR’s RSI is currently at 49.24, up from yesterday’s 36.17. While the upward movement in RSI is generally seen as a positive sign, caution is advised. RNDR has not been able to move past the RSI level of 50 since July 13, so a rejection at this level is a possibility.

The MACD histogram has also seen a slight improvement, moving to 0.015 from yesterday’s 0.009. Additionally, both the market cap and 24-hour trading volume have increased; the market cap is now $544 million, up by 5.21%, and the 24-hour volume is $35.8 million, up by 166.56%.

In terms of resistance, RNDR is approaching a range of $1.482 to $1.503, which coincides with a psychological resistance level of $1.50. Breaking past this range could bring the next resistance into focus, which is the 50-day EMA of $1.576.

On the flip side, immediate support lies at the 20-day EMA of $1.433. Below that, there’s a horizontal support zone ranging from $1.331 to $1.399, aligned with the Fib 0.786 level of $1.333.

RNDR is at a critical juncture. Its performance in the immediate future will likely depend on whether it can hold above the 20-day EMA and break through the immediate resistance levels.

However, caution should be exercised, particularly considering the RSI and the historical difficulty RNDR has had in moving past certain technical levels.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Markets

US National Debt Reaches a Record of $33 Trillion: Economic Crisis in Perspective

The US National Debt has reached a new historic milestone by surpassing the astonishing figure of $33 trillion, according to the most recent fiscal reports. This dizzying increase occurred in less than a year since the debt limit was set at $31.41 trillion in January 2023. This article will analyze the factors behind this unprecedented increase, the role of the debt ceiling, and the implications this has for the American and global economy.

A Limit That Is Constantly Challenged

The debt ceiling is a limit imposed to control how much the U.S. Treasury can actively borrow. It is a crucial tool for maintaining fiscal balance, but throughout history, it has been raised on more than 100 occasions, raising questions about its long-term effectiveness.

Driving Factors of the US National Debt

Several factors contribute to this escalation of the national debt. The response to the COVID-19 pandemic and the assistance provided to Ukraine are significant elements. Additionally, inflation is on the rise, with the United States Consumer Price Index (CPI) reaching a concerning 3.7%. These elements have put pressure on national finances.

The Challenge of Avoiding a Government Shutdown

The United States faces pressure to avoid a government shutdown, as there are only seven legislative days to make crucial decisions. A Defense Appropriations Bill is pending and is considered essential to ensure long-term government funding. However, a collective effort is still required to prevent both a government shutdown and a crisis of the U.S. National Debt.

The Political Perspective

House Minority Leader Hakeem Jeffries points out that the responsibility lies in the hands of the Republicans, but the fight to alleviate the debt burden on American citizens continues. His focus includes pursuing measures that make life more affordable for citizens, cost reduction, creating better-paying jobs, and strengthening communities, among other objectives.

In Conclusion…

The US National Debt has surpassed $33 trillion, marking a historic record and posing significant economic challenges. The decision to raise the debt ceiling once again and the measures taken to address this growing crisis will have a lasting impact on the United States’ economy and its global influence. Time will tell how this situation is resolved and what measures are taken to ensure financial stability in the future.

Markets

These 3 AI Crypto Coins are Bullish in 2023 – Render, Fetch.ai, yPredict

The influence of artificial intelligence (AI) on various sectors is no longer news, and the crypto industry is no exception. In the crypto market, the impact of AI is becoming increasingly evident. AI-centric projects are creating a ripple effect that is influencing the value of their associated cryptocurrencies. Among the multitude of AI-driven initiatives in the crypto space, projects like Render, Fetch.ai, and yPredict are making their presence felt.

As the broader crypto market faces challenges, with Bitcoin struggling to maintain its price above the $25,500 mark, these AI crypto projects offer a glimmer of stability. They present use-cases that extend beyond mere speculation, integrating technological advances into functional, real-world applications.

In a market where many alt coins are finding it hard to sustain their price, these AI-focused tokens offer a promising avenue for future growth. Their impact is not just limited to the crypto market; they have the potential to drive advancements across various sectors, from entertainment to finance and beyond.

The Rendering Revolution: What Makes Render a Noteworthy AI Crypto Project

Render focuses on providing solutions for GPU-based rendering. The project makes the complicated process of converting 2D or 3D computer models into lifelike images more accessible. By allowing people to use their idle GPUs to complete rendering tasks, the platform democratizes the cloud rendering process.

The project was founded by Jules Urbach, who is also known for founding OTOY, a company specializing in cloud rendering services. Another key player in the project is Ari Emmanuel, who currently serves as the co-founder and co-CEO.

According to their distribution plan, 25% of the native Render Token (RNDR) is open to the public, 10% is being kept in reserve, and the remaining 65% is set aside for network operations. The RNDR token plays a central role in the platform’s economy, as it is used to pay for rendering and streaming services.

A recent blog post by the Render team outlined the primary use cases of the RNDR token. These include protecting rights, monetizing content, and empowering individual creators. Users who offer rendering services on the platform can earn RNDR tokens, which can be bought, sold, and held as an investment on various crypto exchanges.

The Automation Advantage: Fetch.ai’s Role in the AI Crypto Sector

Fetch.ai is another player in the AI crypto arena, simplifying daily tasks through AI and blockchain. The platform uses something called a ‘digital twin,’ a virtual bot that represents you and can perform tasks like comparing flight prices across different websites.

These digital twins can also learn and share experiences with each other. For example, if you want to plan a vacation similar to one your friend enjoyed, the digital twins can negotiate the details, sparing you the need for exhaustive research.

Fetch.ai is not just for personal tasks; it’s also finding a role in decentralized finance (DeFi). Within the crypto market, it can identify tokens that are cheaper on one exchange than another and execute purchases on your behalf.

The native token of the platform, FET, serves multiple purposes. It fuels the internal economy of the platform and is used to access various services. Staking FET tokens not only earns interest but also grants users a say in the platform’s future. Requiring FET tokens to deploy a digital twin acts as a safeguard against spam and malicious bots.

yPredict: A New Chapter in AI-Driven Crypto Analysis

While yPredict is still in its presale stage, it has already attracted a significant amount of interest. The platform has raised over $3.81 million of its targeted $4.6 million, with each YPRED token priced at $0.1. Built on the Polygon Matic chain, yPredict will work with YPRED tokens that have a multitude of uses within the platform.

One of the main features of yPredict will be its prediction marketplace. Here, financial data scientists can offer their predictive models as a subscription service. Traders can then subscribe to these models using YPRED tokens, gaining access to valuable trading signals and forecasts. The setup allows data scientists to monetize their predictive models without having to manage trading operations.

In addition to the prediction marketplace, YPRED tokens will be used for other functions, like analyzing various cryptocurrencies and gaining access to data-driven insights. Token holders can also stake their tokens in high-yield pools, which derive their liquidity from 10% of each new user’s YPRED deposit.

Understanding yPredict’s tokenomics will be important for those who plan to use the platform. The total supply of YPRED tokens is set at 100 million, with 80 million allocated for the presale. The remaining tokens are reserved for liquidity and development purposes.

Beyond their utility in the marketplace, YPRED tokens will allow holders to participate in voting processes, contributing to the decision-making within the yPredict ecosystem.

yPredict plans to offer more than just price predictions. The platform will also feature a range of analytical tools, including pattern recognition, sentiment analysis, and transaction analysis. These tools will automatically detect chart patterns, analyze news and social media content related to the asset under consideration, and generate useful data-driven insights.

Adding to its trading focus, yPredict is also developing an AI-powered backlink estimator. The tool is trained on over 100 million links and will predict the backlink profile needed for a site to rank for a specific keyword.

Initially launched as a free preview, the feature received over 5,000 requests within the first 24 hours. It’s now available to the public at a price of $99 per query, according to a recent tweet from yPredict’s official account.

In summary, as the crypto market faces uncertainty, AI-driven projects like Render, Fetch.ai, and the soon-to-be-launched yPredict offer a glimpse of stability and practical utility. These platforms are not just about speculation; they work to solve real-world problems, extending their influence beyond the volatile crypto market.

Disclaimer: Crypto is a high-risk asset class. This article is provided for informational purposes and does not constitute investment advice. You could lose all of your capital.

Markets

Bitcoin Price Prediction as Crypto Market Selling Continues – What’s Going On?

Amid a continued selling trend in the crypto market, Bitcoin‘s value experiences notable fluctuations. As of now, the live price of Bitcoin stands at $25,090, with an impressive 24-hour trading volume of $14.7 billion.

However, despite its market dominance—reflected in its #1 ranking on CoinMarketCap—Bitcoin has seen a dip of nearly 3% in the past 24 hours.

The currency’s live market capitalization is a whopping $488.83 billion, and out of its maximum supply of 21 million BTC coins, 19,482,656 BTC are currently in circulation.

The pressing question on everyone’s mind is: What’s causing this market upheaval?

Bitcoin Price Prediction

Delving into the technical analysis of Bitcoin, it is evident that the premier cryptocurrency has recently witnessed a stark downturn.

Specifically, it has breached a significant triple bottom support at the $25,400 level—a benchmark that had been underscored by the triple bottom pattern visible on the 4-hour timeframe.

The presence of the “Three Black Crows” candlestick pattern on this same timeframe further augments the prospects of a continued bearish trend.

Presently, Bitcoin is navigating the oversold territory. Oscillator indicators, like the Relative Strength Index (RSI), are lingering below the 30 mark, which typically suggests seller exhaustion.

Such a dynamic often paves the way for a brief bullish correction prior to a potential resumption of the downtrend. Concurrently, the Moving Average Convergence Divergence (MACD) indicator has entrenched itself in the sell zone, with histograms forming below the zero line—another beacon of bearish sentiment.

The 50-day Exponential Moving Average (EMA) is positioned around $25,500, and with Bitcoin currently priced at approximately $25,200, and consistently trading below the 50 EMA, the bearish bias remains robust.

From this technical analysis point, Bitcoin is poised to encounter resistance around the $25,400 level.

A modest bullish correction up to the $25,600 level might merely be a precursor to a deeper dive, potentially targeting the next support level at $24,800.

If Bitcoin was to decisively undercut the $24,800 level, the subsequent support is anticipated around the $24,000 mark. It’s also worth noting a descending trend line, currently posing as a significant barrier around the $25,600 mark.

However, should Bitcoin muster a bullish breakout above this line, the gates might open for a rally towards the $26,400 level or even as high as $46,000.

In summation, the $25,600 level emerges as a critical juncture, likely serving as today’s pivotal point in the trading landscape.

Top 15 Cryptocurrencies to Watch in 2023

Get ahead of the game in the world of digital assets by checking out our carefully curated selection of the top 15 alternative cryptocurrencies and ICO projects to watch for in 2023.

Our list is compiled by industry experts from Industry Talk and Cryptonews, so you can expect professional recommendations and valuable insights for your cryptocurrency investments.

Stay updated and discover the potential of these digital assets.

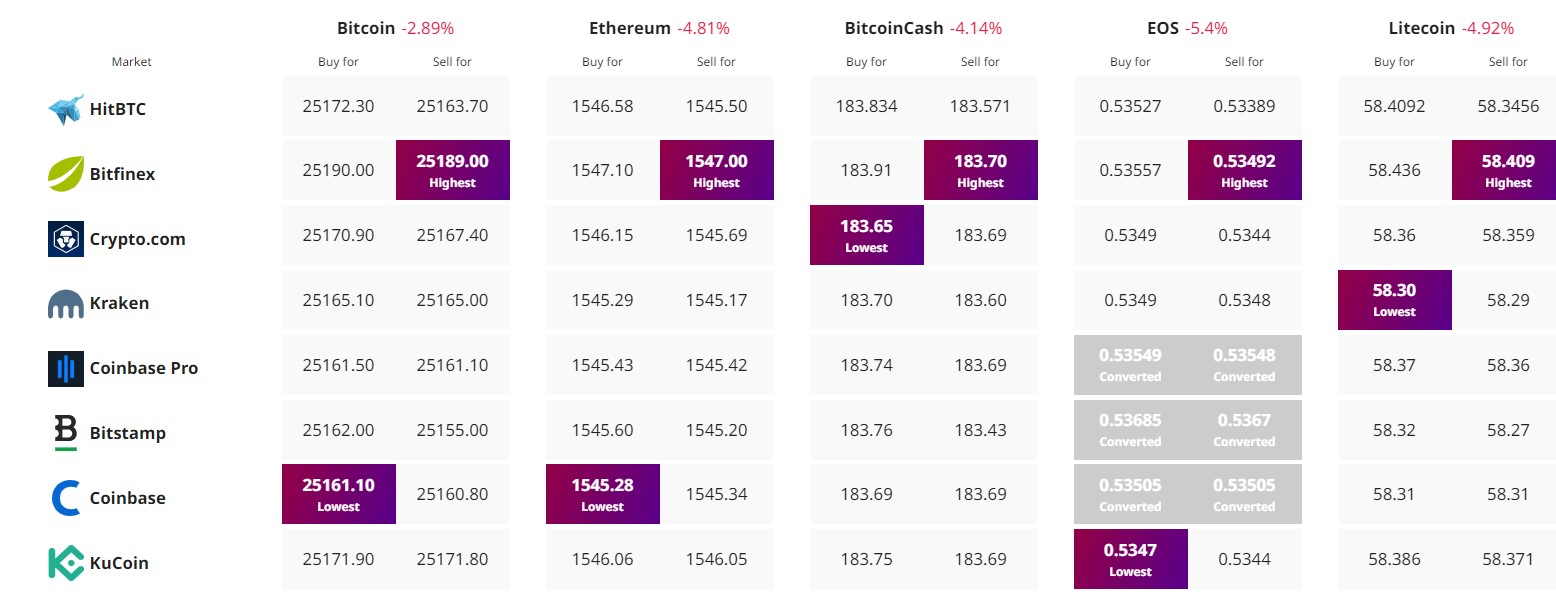

Find The Best Price to Buy/Sell Cryptocurrency

Disclaimer: Cryptocurrency projects endorsed in this article are not the financial advice of the publishing author or publication – cryptocurrencies are highly volatile investments with considerable risk, always do your own research.

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know