Altcoins News

Binance Coin (BNB) market cap beats Santander and UBS

2021 has been an impressive year for Binance Coin (BNB), which has so far recovered by more than 900%.

One of the main drivers of BNB’s growth was the continued congestion on the Ethereum network. As this fight continued, Binance Smart Chain (BSC) emerged as an alternative, meeting the demands of the rapidly growing decentralized finance (DeFi) sector.

As BNB reached a market capitalization of $64 billion, it has outperformed traditional banks, including Santander, the Bank of Montreal and UBS. Meanwhile, some analysts point to the estimated value and impact of Coinbase’s upcoming direct listing ($100 billion valuation) as a catalyst for BNB’s price hike.

A common narrative that emerged in recent weeks is that COIN direct listing is also adding value to centralized exchange tokens. Analysts also speculate that other US-based regulated exchanges such as Kraken and Gemini will likely go the way of Coinbase and attempt to raise funds through a stock offering.

To understand the potential of BNB, one must first understand the differences between stocks (stocks). Once this is clarified, it will be possible to analyze the possible drivers of the appreciation of BNB.

BNB does not represent Binance shares

The BNB token offers holders a discount on trading fees, and is mandatory for those who wish to participate in Binance Launchpad token sales. As BNB gained liquidity, it also became a base pair for other cryptocurrencies on the Binance exchange.

Over time, other uses emerged as the Binance Smart Chain gained ground. For example, BNB can cover network fees and serve as a utility token in the ecosystem, which includes decentralized applications (dApps) and games.

Binance periodically burns (destroys) some of the non-circulating BNB tokens based on the overall trade volume of the exchange. The effectiveness of this strategy waned over time as investors understood that these destroyed tokens never entered the circulating supply.

The Binance Smart Chain network uses a proof-of-stake authority that eliminates the need for miners or expensive transaction fees. The platform maintained its compatibility with Ethereum Virtual Machine (EVM) and has a similar token and smart contract structure.

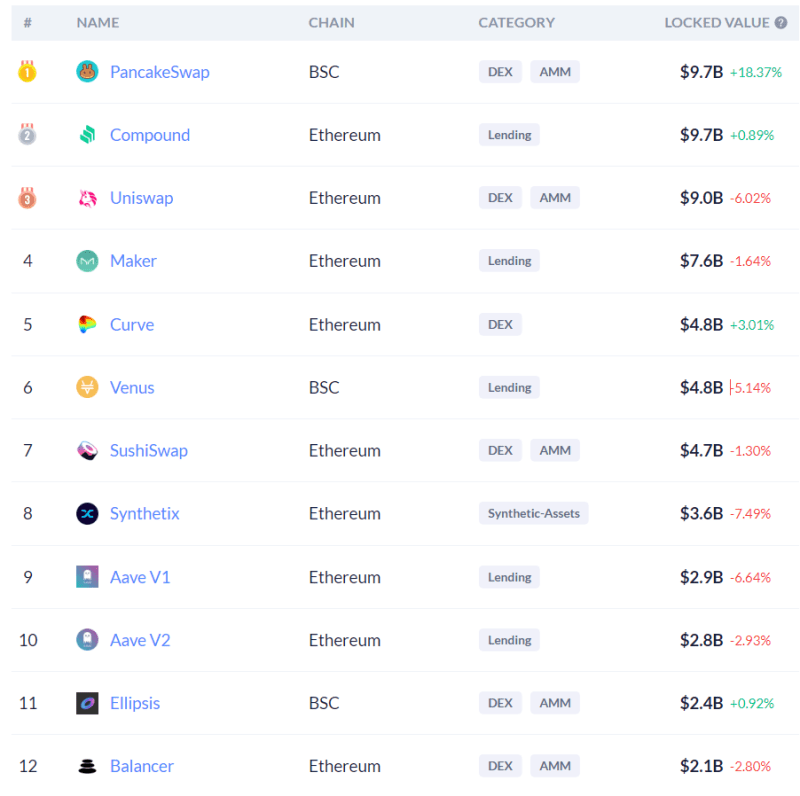

Many tokenized (or pegged) cryptocurrencies have gained prominence on Binance networks, allowing users to bypass miners’ fees. Another benefit provided by Binance Smart Chain’s BEP-20 model is the participation and farming capabilities in its vast network of decentralized applications, including the PancakeSwap DEX and Venus lending platform.

As shown above, Binance Smart Chain has been gaining ground over other DeFi protocols in terms of total locked value. Thus, new use cases for the BNB token emerged to take center stage as agriculture, liquidity pools, and base pairs used the token across the network.

Banks are trusted dividend providers, but DeFi could outperform the system

Equity shareholders are entitled to a portion of the net profits of publicly traded companies. This amount will vary from quarter to quarter, as the board of directors can choose to pay off the debt or add part of that money to reserves. However, banks are notorious cash cows and therefore are often a reliable source of dividend payments.

Santander (SAN) dividends paid over the past 12 months divided by the current share price show a 3.7% gain, and Bank of Montreal (BMO) shareholders received a similar return. Yields at Switzerland-based UBS were down in 2020, but have historically averaged 5%.

Bank shareholders do indeed have voting rights at shareholders’ meetings, and minority groups could block measures that would hurt them financially. On the other hand, these shareholders are 100% dependent on the bank’s net income and growth.

BNB, on the other hand, could survive without the direct influence of the Binance exchange. In the future, if Binance Smart Chain achieves independent developers and validators, its ecosystem could continue to prosper. In theory, if the token loses its dependency as the ecosystem grows, it becomes less centralized.

Done right, BNB’s market capitalization could exceed that of the entire traditional banking system, but before this happens, these decentralized networks and applications must gain adoption and demonstrate that they can address the needs of major investors. and bank customers.

Altcoins News

Shiba Inu: Celebration for the Burning of 176 Million SHIB in a Historic Transaction

In an exciting development for the Shiba Inu community, September 20 marked a significant milestone as Shiba Inu’s official burn tracker announced that over 176 million SHIB tokens had been burned in a single transaction. But that’s not all; in the last 24 hours, a total of 135,933,606 SHIB tokens were burned, adding up to an impressive total of 521,814,163 tokens burned in just 7 days.

Impact on SHIB Price

As expected, this exceptional event has captured the attention of the cryptocurrency community and Shiba Inu investors worldwide. In the latest hourly update provided by Shibburn, the current price of the meme coin stands at $0.0000073, with a slight 0.15% decrease in the last hour. Although there has been a 1.34% decrease in the price in the last 24 hours, Shiba Inu’s market capitalization remains strong, valued at $4,297,527,749.

Lucie: The Voice of the Shiba Inu Community

On September 18, a key member of the Shiba Inu team, known as Lucie, addressed the community to answer burning questions about the highly anticipated SHIB token burn in Shibarium. Lucie emphasized that token burns are scheduled per transaction, meaning they occur based on the level of community participation. In a passionate plea, she urged SHIB holders to support this effort, stressing that SHIB burns are the result of close collaboration between developers and the community.

Lucie also pointed out that while it’s exciting to see enthusiasm for token burns, it’s crucial for the community to understand that SHIB burns are a community-driven initiative and not a call for developers to take immediate action.

Shibarium’s Focus: Strengthening BONE ShibaSwap

Amidst this backdrop of token burns, the Shibarium team has shifted its focus to strengthen the Bone ShibaSwap token, also known as BONE. Lucie emphasized that the implementation of BONE aims primarily to safeguard the interests of investors. To achieve this goal, the team has implemented a temporary locking contract along with a decentralized multi-signature wallet, ensuring maximum protection for Shiba Inu investors.

Shibarium’s Success with NOWNodes

Recently, Shibarium achieved an impressive feat by processing over 7 million RPC requests for the network in just one week. This achievement sets a new record for the platform and underscores the growing importance of Shibarium in the cryptocurrency ecosystem. NOWNodes, a node service provider supporting more than 80 blockchain networks, reported on this noteworthy accomplishment, highlighting Shibarium’s increasing relevance in the world of cryptocurrencies.

The Shiba Inu community is excited about these recent developments and the massive SHIB token burn, further bolstering their confidence in the project. With Shibarium gaining momentum and active community engagement, the future of Shiba Inu appears bright in the world of cryptocurrencies.

Altcoins News

Crypto Enforcement Funds Under Scrutiny: Congressman Emmer Calls For Restrictions On SEC

In a recent statement, Congressman Tom Emmer, a prominent figure in the GOP and a staunch advocate for crypto, expressed his concerns regarding the actions of Securities and Exchange Commission (SEC) Chair Gary Gensler.

Emmer accused Gensler of abusing his authority, leading to the expansion of the Administrative State while “disregarding the interests of the American people”.

To address these concerns, Emmer plans to sponsor an appropriations amendment aimed at restricting the SEC’s use of funds for crypto enforcement until clear rules and regulations are established.

Emmer Advocates For Clear Rules In The Crypto Industry

Emmer’s criticism of Chair Gensler centers on what he perceives as the weaponization of taxpayer dollars. Emmer argues that Gensler has utilized his position to further centralize regulatory control without ensuring a transparent and regulatory-friendly environment for the crypto industry.

By proposing to restrict the SEC’s funds for digital asset enforcement, Emmer seeks to emphasize the need for clear guidelines that protect both investors and innovators in the crypto space.

Addressing Senator Elizabeth Warren’s stance on cryptocurrencies, Emmer refers to her as a “control-freak senator” with an inclination towards centralized control.

He suggests that Warren favors a government-owned banking system and desires to retain the centralized power that comes with central banking. Emmer acknowledges the importance of central banking’s role but emphasizes the need for its evolution to adapt to the 21st century.

Emmer further asserts that attempts to suppress digital assets and cryptocurrencies are futile. He cites China’s unsuccessful ban on mining activities as evidence that even authoritarian regimes struggle to control decentralized technologies.

Emmer believes that a country like the United States, which “cherishes freedom”, cannot impede the progress of digital assets and cryptocurrencies.

The congressman’s remarks shed light on his perspective as an advocate for the crypto industry and his concerns regarding regulatory overreach. Emmer emphasizes the necessity of clear and balanced regulations that foster innovation while protecting investors.

By sponsoring an appropriations amendment, he aims to use the legislative process to ensure that the SEC’s enforcement actions align with well-defined rules and regulations.

As Emmer’s proposed amendment gains attention, it reflects the ongoing debate surrounding crypto regulations in the United States. The crypto industry seeks regulatory clarity to foster growth and innovation, while regulatory bodies like the SEC aim to protect investors and maintain market integrity.

Finding the right balance between oversight and innovation remains a key challenge, and Emmer’s efforts contribute to shaping the future of crypto regulation in the United States.

It remains to be seen how Emmer’s appropriations amendment will progress through the legislative process and how it will be received by his colleagues.

As the nascent industry continues to evolve, the role of Congress and regulatory agencies in establishing a clear and balanced regulatory framework will be crucial for its long-term success and widespread adoption.

Featured image from iStock, chart from TradingView.com

Altcoins News

US Forces Young Hacker To Forfeit $5.2 Million In Bitcoin

Last month, Ahmad Wagaafe Hared, a young hacker based in the United States, was ordered to forfeit approximately $5.2 million worth of Bitcoin (BTC), Stellar (XLM), and a BMW sports car to the government. According to a report, this order was made last week due to Hared’s involvement in a SIM-swapping scheme that targeted crypto executives in North California and the Bay Area.

The Bitcoin SIM-Swapping Hack

The SIM-swapping scheme, orchestrated by Hared–who went by the alias “winblo” — began in 2016 and was stopped by local authorities in 2019.

Hared and his accomplices obtained their victims’ contact information before entering a plea agreement with law enforcement agencies. They would then contact cellphone service providers, manipulating company representatives into believing they were the legitimate owners of the targeted phone numbers.

After that, they swapped cards, illegally taking control of their victims’ phone numbers. With this scheme, the hacker gained unauthorized access to their victims’ email and other crypto accounts before transferring coins.

The success of this scheme is evident in the significant amount of assets ordered for forfeiture. Hared must surrender 119.8 BTC, valued at $5.2 million, and 93,420 XLM, worth $11,770. A 2017 BMW sports car, believed to be proceeds of crime, must also be surrendered to the state.

The young hacker has been under arrest for over three years now. As mentioned, in 2019, Hared entered a plea agreement, though many case documents remain sealed, and the deal has not been disclosed to the public. Hared will be sentenced in January 2024 after pleading guilty to conspiracy to commit wire fraud.

According to details, this case is tied to another SIM-swapping scheme, which saw the indictment of Anthony Francis Faulk, also known as “shade,” who pleaded guilty to conspiracy to commit wire fraud in 2019.

Hackers Have Stolen Over $200 Million In 2023 Alone

In a recent report, blockchain intelligence firm Chainalysis claimed that hackers linked to North Korea have stolen over $200 million worth of cryptocurrencies to finance their nuclear weapons program.

In August, Lazarus Group said to be sponsored by the North Korean regime, was linked to the $34 million CoinsPaid hack. They were also reportedly behind the Stake.com hack, the FBI claims. The hit on the crypto casino saw over $40 million of coins robbed.

As part of their activities, hackers employ several tactics to steal Bitcoin and coins, including SIM-swapping, phishing, supply chain attacks, and infrastructure hacks.

Feature image from Canva, chart from TradingView

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know