DeFi News

What is Synthetix (SNX)?

Synthetix (SNX) is a striking decentralized platform that is focused on the creation of synthetic securities that allow interacting with different assets as if it were a native representation of them but in a completely decentralized market.

The world of commerce today is dominated by the trading of stocks, currencies, raw materials and other assets that we can see in the different exchanges and markets worldwide. This is undoubtedly an enormous potential that those of us in the crypto world cannot reach directly, but what if we could? What if there was a platform capable of representing all these assets and making it available to crypto hodlers?.

Well, this is precisely what Synthetix wants to achieve. For this, this project has created a set of decentralized tools that allow you to interact with “financial synthetics” with complete confidence. You want to know more? Then keep reading this interesting article designed to explain what Synthetix is and what this platform is looking for DeFi or decentralized finance.

Synthetix (SNX), a DeFi platform for synthetics

Synthetix is a decentralized finance protocol or DeFi, which has been created to issue synthetic assets over Ethereum (ETH). These synthetic assets within the platform are guaranteed by the Synthetix Network Token (SNX), a ERC-20 token that once blocked by the Synthetix contract, allows the emission of synthetic actives (called Synths) within the platform. These Synths assets can represent anything and you have the ability to interact with them without the need for third parties. In this way, Synthetix can represent assets, stocks, fiat currencies and commodities without major problem.

For example, it is possible to create a Synths that emulates the gold market, and we can interact with it from the Synthetix platform and from exchanges that support this platform. But what exactly is a “synthetic”?

What is a “synthetic”?

Now, to understand Synthetix, it is necessary to understand what exactly a “synthetic” is. So we can say that; Synthetics or synthetic positions are assets created in order to represent assets within a market, interact with it and benefit from the properties of said asset, without actually having it.

These assets seek to facilitate exposure to different assets or commodities without having to deal with problems such as custody, maintenance or other needs for the management of that asset represented. All this without giving up the potential of the represented asset, such as its value, its liquidity or its wide acceptance throughout the world.

Origin of Synthetix

The Synthetix project began as under the name Havven, a project devised by Cain Warwick. The product of this project was the stablecoin nUSD which was released on June 11, 2018. However, in December 2018, the project was renamed to Synthetix, creating a platform capable of representing more than 20 synthetic assets capable of representing fiat currencies, commodities (for example, gold), and crypto assets.

The evolution of the project since then led Synthetix to be one of the largest projects in DeFi. And it is that before all the DeFi explosion, already had more than $180 million USD in SNX tokens locked in the protocol as of December 2019. Currently, the market value of Synthetix exceeds $1000 billion, making it clear that it is one of the largest DeFi projects in the world. ecosystem.

How does Synthetix work?

The operation of Synthetix requires that this platform allows the creation of different tokens that each represent the synthetics or Synths within the platform. Each Synths is in turn supported by a system of guarantees, participation, inflation control, fees and governance.

Thus, for example, if we want to create a Synths that represents the gold market, Synthetix will create a token for this new Synths (for example, sGOLD). This new token within Synthetix will be joined by an entire support infrastructure governed by smart contracts. This infrastructure is the system of guarantees to avoid unwanted losses in the system, the control of inflation, rates, oracles and the governance over that specific Synth. At all times, the Synthetix Network (SNX) token is key to controlling these parameters, since blocking this token is what will allow the creation of new sGOLD tokens to the desired extent.

If you look closely, this operation looks a lot like MakerDAO and DAI. Remember that in MakerDAO we can use different tokens to create DAI. Well, the same happens in Synthetix, only that in Synthetix we can create several Synths according to the programmed.

At this point, the inclusion of oracles is vital for the functioning of Synthetix, since they are the means of connection between the real world, the represented assets and the actions of the Synths on the platform. For example, if gold falls in price on the international market, the oracle will take this information to Synthetix and cause the price of our Synths sGOLD to lower its price in line with the international market. This oracle system in Synthetix is provided by ChainLink (LINK).

SNX tokens and their monetary policy

The history of the SNX token begins with Havven and his ICO (Initial Coin Offering) in which $ 30 million USD was raised with a total supply of 100 million Havven tokens. However, with the evolution of the platform to Synthetix, the token underwent a transformation, being renamed Synthetix, and having an issue of up to 250 million tokens.

The distribution of these tokens would be done with an increase in the SNX offer to 175 million by March 2020. From that point, the token offer would be increased as follows:

- In March 2021, SNX supply will increase from 175 million to 212,5 million (21% increase).

- By March 2022, SNX’s offer will reach 231,25 million (9% increase).

- By March 2023, the supply will increase to 240,625 million (4% increase).

- And finally, in March 2024, the total supply will reach 245,312,500 SNX (2% increase).

In order to mitigate the instantaneous dumping of SNX rewards by SNX providers, which puts downward pressure on the SNX price and thus undermines the value of the SNX collateral staked, the SNX rewards distributed from March 2019 to March 2020 they are blocked and cannot be sold on the open market during this period. However, the SNX obtained from bets can be used as collateral to create new Synths.

In this sense, SNX fulfills two very clear functions:

- It is a token that is used to create Synths, allowing to establish the participation, purchase and earnings of a Synth. For this, the SNX tokens must be collateralized at a ratio of 750% (C-Ratio), or be invested in the platform as a stake that serves as a stabilizer for the Synths.

- It allows establishing a means of governance in the Synthetix DAO. Thus SNX token holders can vote for Synthetix improvement proposals (SIP) and participate in the governance of the protocol.

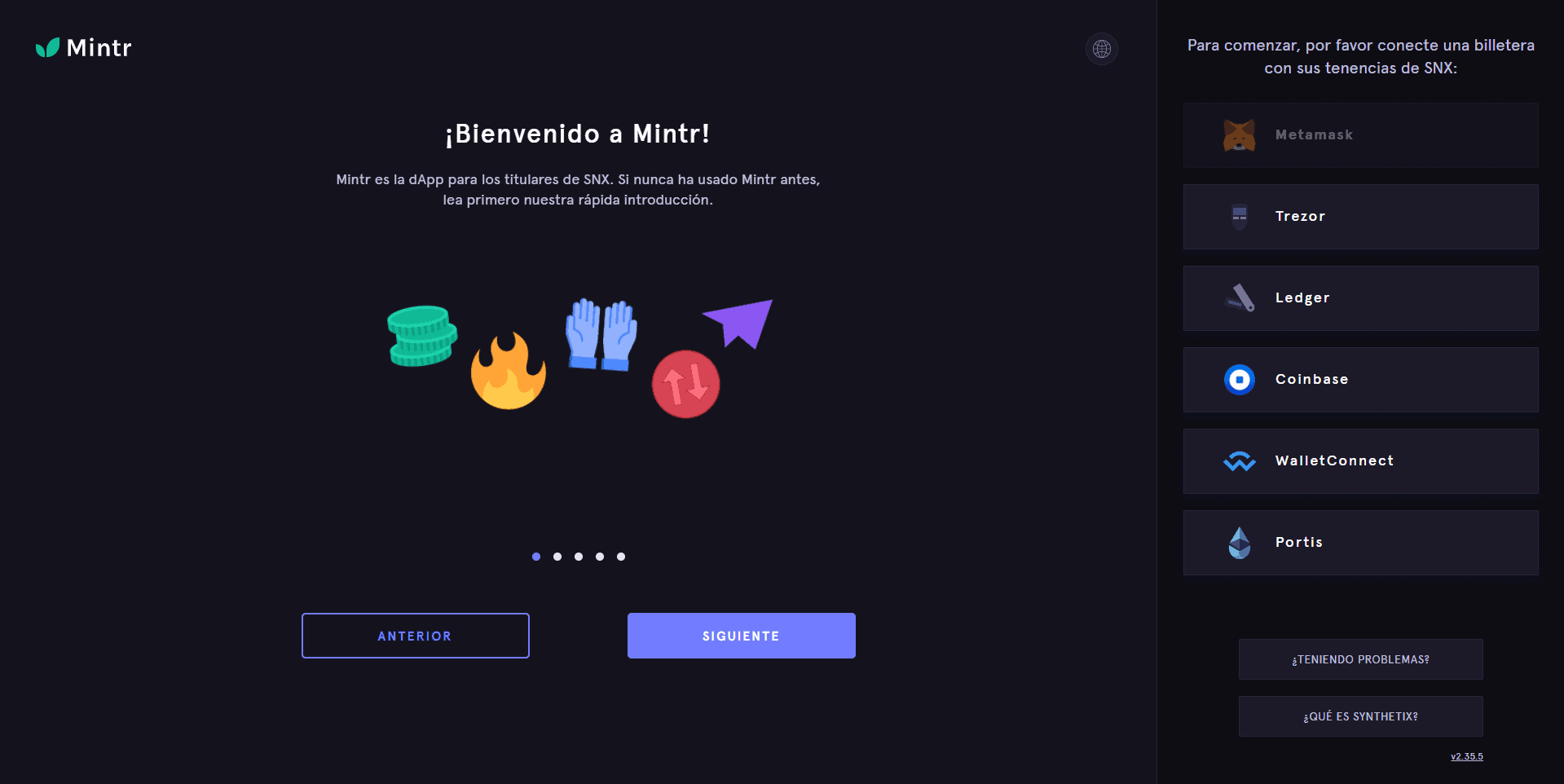

Mintr, a DApp to interact with the protocol

To facilitate the entire process of creating SNX tokens, Synthetix has created Mintr, a DApp (Decentralized Application) that allows users to mint Synths (sUSD), using as collateral on deposit an amount of SNX tokens that obeys a factor of 750%.

To carry out this process it is necessary to follow a series of steps that are:

- First, connect your wallet to the DApp Mintr. This wallet must have SNX tokens in its possession in order to be able to operate with the platform.

- Second, the user must indicate to Mintr that he wants to mint sUSD tokens, using as collateral the SNX tokens he deems appropriate. Said SNX tokens will be blocked.

- Finally, the user will be able to trade with the available Synths using the sUSD obtained, and will be able to stake with the SNX that he deems appropriate to receive periodic weekly rewards from the system.

Every time a user interacts with Mintr to acquire Synths, the DApp makes a call to the Synthetics smart contract, which is in charge of managing all the processes necessary to mint said Synths.

Synthetix Governance

As we have already mentioned, SNX token holders can participate in the governance of the Synthetix protocol. However, participation when it comes to governance is limited, making it clear that Synthetix is not a highly decentralized system.

For example, the design of the basic protocol, the setting of the incentive parameters, and the development of the system are currently governed by the Synthetix Foundation, leaving such points out of community governance.

On the other hand, Synthetix has a development control system very similar to that of projects like Bitcoin and Ethereum. All this thanks to the SIP or Synthetix Improvements Proposals which are nothing more than open documents that describe the protocol standards and the proposed updates. In these, anyone from the Synthetix community can participate and contribute their ideas and theories to improve the protocol.

Historically, SIPs have been used to modify the fee / reward structure, allow for the liquidation of unused synthesizers, introduce new synthesizers, and implement various initial foreign exchange execution protections. They are an appropriate mechanism for a wide range of fundamental alterations to the Synthetix platform and, as such, require an organized process of community consultation and iteration.

Furthermore, the DAO Synthetix is a governance mechanism where the community also has a place and representation. The DAO consists of 3 community members and 2 main contributors, and an interface is available to the public at snxgrants.io.

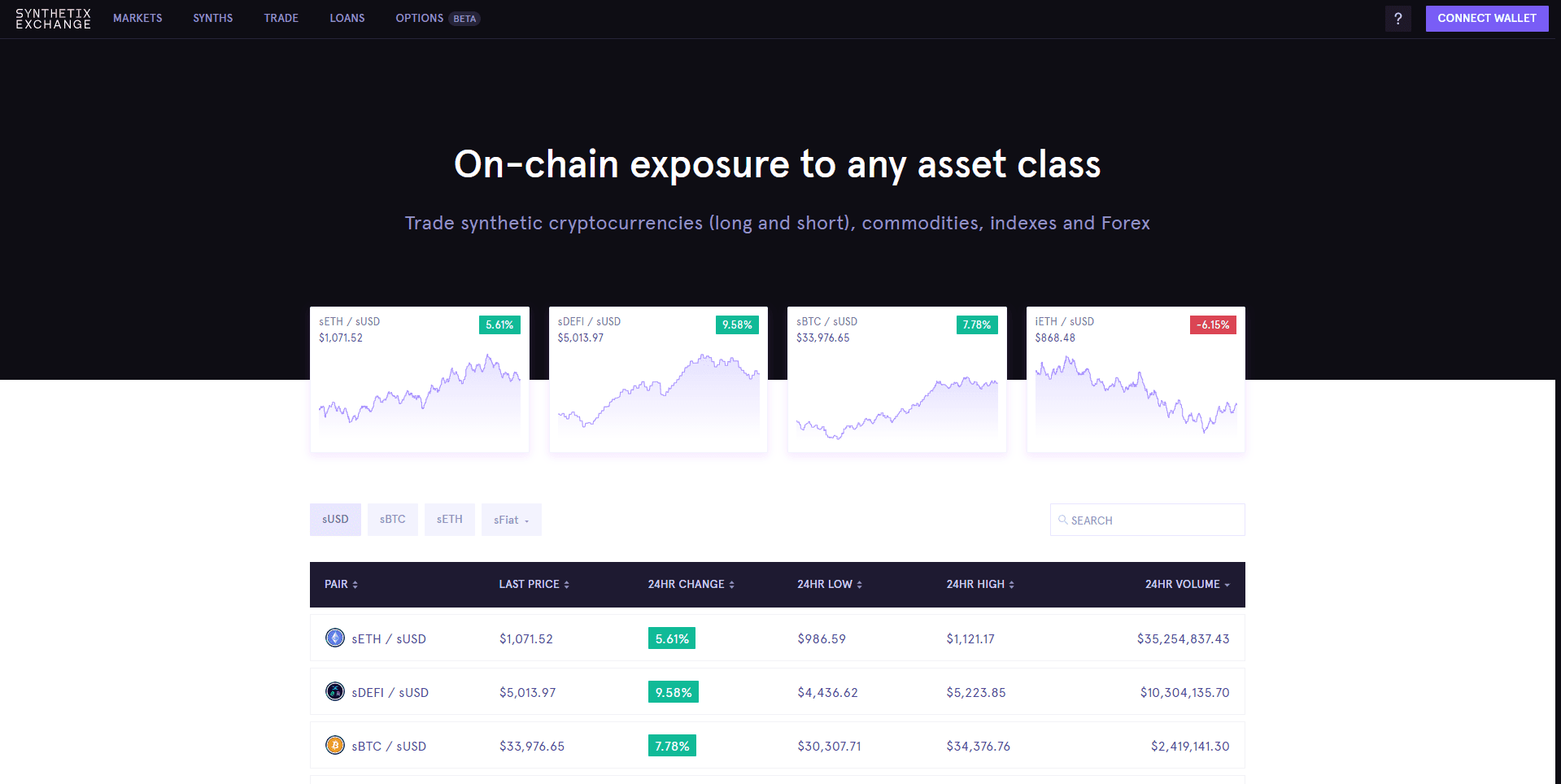

Synthetix Exchange, a DEX for Synths and much more

Now, how to do to trade the Synths of this platform? Well, for this, Synthethix has created the Synthetix Exchange, a DEX (decentralized exchange) that allows to operate with Synths within the platform.

Synthetix Exchange currently works with 5 different Synths categories, which are:

- Fiat currencies: such as sUSD, sEUR and sJPY, among others.

- Commodities: synthetic gold, and synthetic silver (measured per ounce).

- Cryptocurrencies: such as sBTC, sETH, and sBNB.

- Inverse cryptocurrencies: iBTC, iETH, and iBNB, which inversely track the price of cryptocurrencies. In this way, for example, when the price of BTC increases, the price of iBTC decreases in the same proportion, and vice versa.

- Cryptocurrency indices: currently working with sDEFI/iDEFI, and sCEX/iCEX, which follow a basket of DEFI assets, and a basket of native DEX tokens.

- Inverse cryptocurrency indices: currently working with iDEFI, and iCEX, which follow a basket of DEFI assets, and a basket of native DEX tokens.

In short, it is a space created in order to facilitate operations with the Synths of the platform, allowing you to exchange, buy or sell Synths as you like. But not only that, this DEX also allows you to use these Synths (such as sETH and sUSD) to request loans from the same exchange interface. The operation of this loan system is identical to that of platforms such as AAVE, so you must place a guarantee in order to access the requested loan.

The exchange platform also allows other functionalities such as the creation of liquidity pools that are connected to protocols such as Curve, Balancer, Uniswap y Compound, which allows obtaining and improving platform incentives for SNX token stake holders. Outcome? The protocol enables the ability of yield farming and liquidity mining with fairly moderate earnings.

Pros and cons of Synthetix

One of the main advantages of Synthetix is that it diversifies the exchange options in the crypto world, and the best thing is that it does so by making use of a completely decentralized platform. Additionally, the system always seeks to provide a high level of liquidity in the market and to do so with zero slippage or slippage in price.

Another point in favor is that Synthetix opens the doors to access products in international markets without any censorship. For example, if for some reason there is a veto that prevents us from accessing the silver and gold market, we can do so through Synthetix.

On the other hand, one of its great cons is the level of complexity of its smart contracts and the centralization points in the development of the system. The defense of the developers against these criticisms is that given the complexity, having central control points prevents any security problem from affecting the protocol for a long time, and at the same time allows solving these problems more quickly and easily.

DeFi News

UK updates its tax policies on DeFI and Staking loans

The UK’s tax authority, Majesty’s Revenue and Customs (HMRC), released an update to its guidance on Wednesday, reported Bloomberg.

The new policy provides a series of “guiding principles” that act as general guidance in determining whether DeFi-related return or participation should be classified as income or capital gain.

How loan returns or staking is taxed depends on whether it is considered capital or income, however determining this can be a complex task. In the post, the HMRC admitted about this difficulty:

Token lending/staking via Decentralized Finance (DeFi) is a constantly evolving area, so it is not possible to establish all the circumstances in which a lender/liquidity provider makes a return on their activities and the nature of that performance. Instead, some guiding principles are established.

New policy to tax DeFi and staking

The latest guide sets out four distinct points designed to make it easier for people to determine the nature of their tax. Firstly, if the return received by the lender or liquidity provider is known “at the time the agreement is made”. If known, it would indicate a revenue receipt, but if unknown, it would indicate a capital receipt.

Second, if the return is realized through the disposal of a capital asset, it qualifies as capital. Conversely, if the borrower, or the DeFi lending platform, pays the yield to the lender/liquidity provider, the yield should be classified as income.

Third, the regulator indicated that lump-sum payments are “more likely” to qualify as principal; while recurring payments are “more likely” to be in the nature of revenue. Finally, the HMRC mentions the loan period as another variable that determines the nature of the repayment, everything will depend on whether it is “fixed or indefinite, short or long term”, he said.

The document presents some examples of how users can determine the nature of their loan return or participation. For example, if the return amount has already been agreed upon, say 5% per annum, it will most likely be a revenue receipt, the regulator said. On the other hand, if the income is “unknown and speculative”, it is probably a capital receipt.

As CoinDesk noted, the new policy is an update to previous guidance that had been published by HMRC in March 2021. According to that document, taxation of staking trades depended on whether the activity amounted to “taxable trading.” The wording closely resembled the established rules for taxing cryptocurrency mining, the outlet adds.

DeFi News

New SEC Definition Includes DeFi Exchanges

The US Securities and Exchange Commission (SEC) is interested in the fact that the definition of a stock market would now be much broader, also encompassing systems that allow buyers and sellers to communicate their interest in trading this type of asset, which which would include decentralized exchanges (DEX) such as Uniswap, PancakeSwap and many others for bringing together this type of people interested in trading digital currencies.

The measure would require platforms that meet these characteristics to register with the US Securities and Exchange Commission as securities brokers, and since decentralized exchanges would not be able to meet the demands required by this type of license, this could imply the imminent cessation of its operations throughout the United States.

More delicate than it seems

Some analysts and enthusiasts express concern about the possible repercussions this could have for the sectors associated with digital currencies.

In this regard, the DeFi sector enthusiast, Gabriel Shapiro, presented an even more delicate panorama for this type of exchange, since such a definition could also address even block explorers, such as Etherscan, precisely because they allow users to users interact with smart contracts to communicate business interests.

In this sense, it highlights that all this can be interpreted as a restriction on freedom of expression, for which it would be completely unconstitutional.

From a regulatory point of view, the SEC commissioner, Hester Peirce, also expressed her concerns and echoed some aspects mentioned above, placing special emphasis on the broad and diffuse nature of the changes proposed by the entity, which even go far beyond the scope and jurisdiction of the regulatory body.

On the other hand, Peirce criticized the fact that the interested community has very little time to read, understand and consider the proposal, which is not consistent with the implications it could have, since it would be making changes to an ecosystem that moves thousands of million dollars, which it could harm in unforeseen ways.

DeFi News

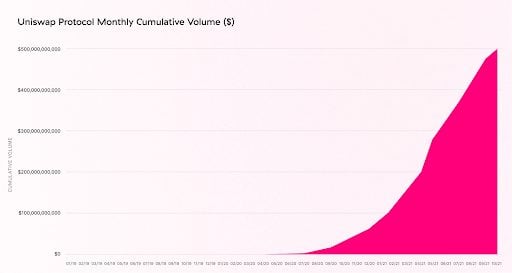

Uniswap exceeds US$500 billion in traded volume since its launch

One of the best-known decentralized exchanges in the cryptocurrency market has just passed the US$500 billion transacted mark.

“We’re proud of the magnitude of this number, but we’re even happier knowing that millions of users have had direct access to markets they could trust were operating in their best interest.” – stated Uniswap Labs on Twitter.

About 2 billion of this volume was thanks to two scalability solutions integrated into the project:

“⚡️ $2 billion of this volume was contributed by @arbitrum and @optimismPBC deployments, which are starting to see significant traction!” – said Uniswap Labs.

Uniswap was created in November 2018, but it was conceived in 2016 by Vitalik Buterin (creator of Ethereum). With support from the Ethereum Foundation, programmer Hayden Adams made the idea come true.

Since then, the broker has not stopped growing and its UNI token is already worth 14.35 billion dollars.

With Uniswap, anyone can be an arbitrator between tokens using the blockchain, which narrows the price gap in small markets and gives incentives to balance asset prices using blockchain and centralized brokerages.

Currently, UNI is traded in several brokers in EEUU and around the world, such as Coinbase, Bitfinex and Binance US.

“We are so grateful to be together on this journey with our incredible community, and we can’t wait to hit the $1tn mark.”

-

Opinion2 years ago

XRP: FOX Business Senior Correspondent Says SEC Is Losing Its Lawsuit Against Ripple

-

Tutorials3 years ago

How to Earn, Farm and Stake CAKE on PancakeSwap with Trust Wallet

-

Altcoins News3 years ago

Projects with ongoing migration from Ethereum to Cardano

-

NFT3 years ago

CardanoKidz: The first NFTs arrive at Cardano

-

Tutorials3 years ago

How to set up a Bitcoin node: beginner’s guide

-

NFT3 years ago

SpaceBudz: new astronaut NFTs on Cardano

-

DeFi News3 years ago

Uniswap vs PancakeSwap: Full analysis

-

DeFi News3 years ago

Liqwid Finance the first DeFi project on Cardano: everything you need to know